TL;DR: As seen in Blurring DD part 3 a free and fair market will be on a self-custodial defi blockchain (link see below) which needs to be built on an open source platform. This will render nearly everything in the short toolkit useless. Stocks will no longer behave like infinite fiat money supply where you can always borrow more, but rather a finite share of a company. One thing left to them are (meme) stock traps. We have to begin understanding them. The DD has just begun.

Topics:

- A really free and fair market

- How would shorting work in such a market?

- Comparing todays short technics with those in a free and fair market

- What is left for shorts and how can we be one or two steps ahead?

A really free and fair market

First I want to thank the team of DRS GME, especially chives who went through several iterations of the post with me. I started writing it in mid 2022 and happy to share the thoughts now.

Counterfeit Shares 2.0 lists a lot of ways to create a counterfeit share. During the last years we got ample evidence that this is how the stock market operates (see last DD https://lemmy.whynotdrs.org/post/331876/). Looking at the loopring whitepaper (https://loopring.org/resources/en_whitepaper.pdf) and imagine a stock exchange based on self-custodial wallets and decentralized exchanges there eventually cannot be counterfeit assets, given certain conditions (see below). In this environment Fails to Deliver, Settlement Fails, Wrong labeling, False Locates, Naked Options and Perpetual Rolling may not occur. For context this is all about the loopring technology based on Etherium and not about their token (LRC).

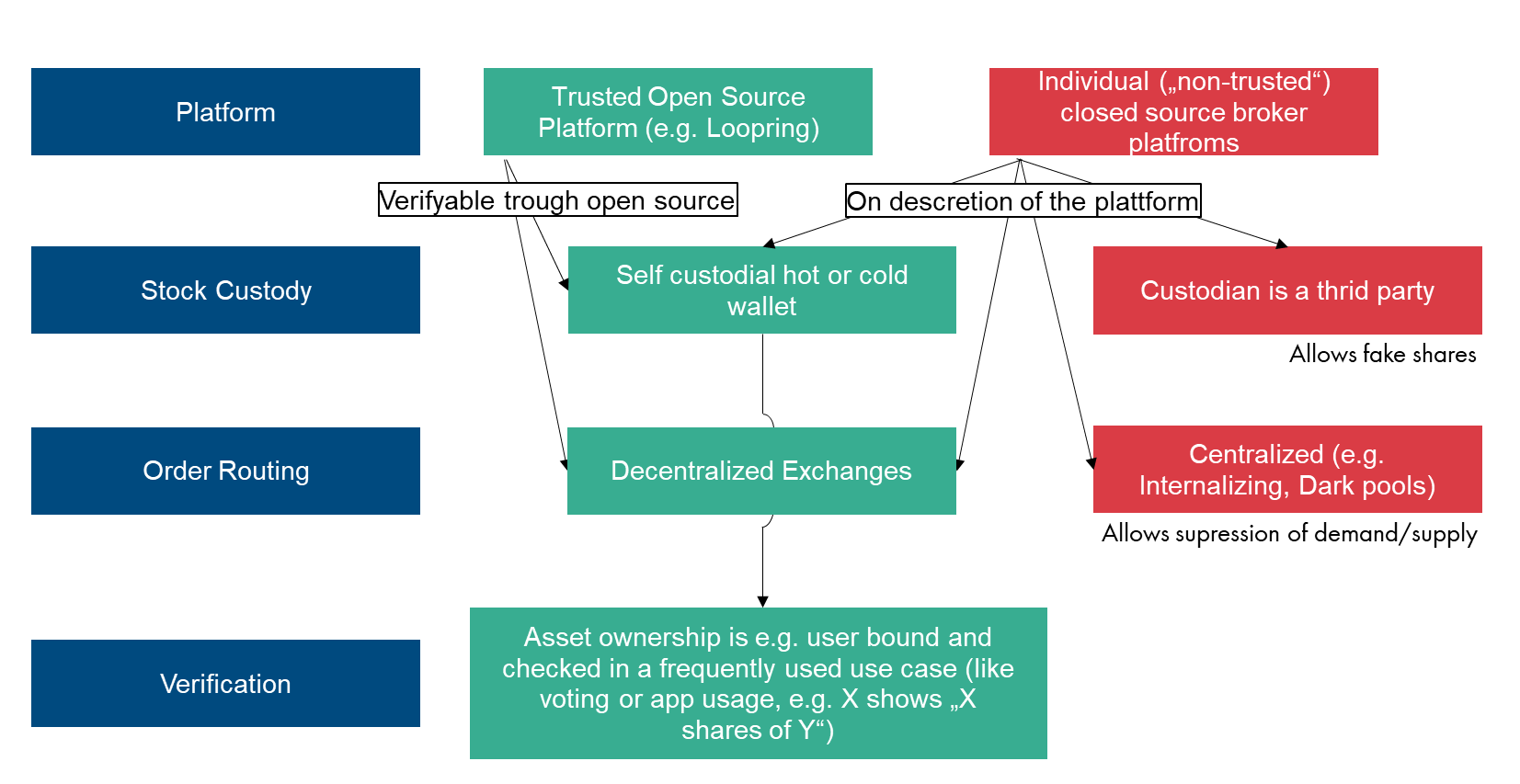

As main condition everyone would have to use the particular uncompromised platform. E.g. the loopring wallet app for iPhone or Android, again not talking about LRC as a token here. If on the opposite every broker kept its own platform and would pinky promise to connect to the Loopring backend, we could probably end up in the same situation as today. Brokers could internalize orders or route to only certain exchanges. So how to solve this? A) only allow “Loopring App” for holding and trading shares B) implement authenticity checks at B1) shareholder interactions, like voting B2) other purposes, like interacting with products of the company (e.g. the Twitter Account would connect with your wallet and show the amount of shares you own). So this as an example for the “ownership” part (see also the DD about ownership here (https://lemmy.whynotdrs.org/post/331878), for the exchange part solution A would solve the issue, B maybe. A graphical overview of those stages:

We will go on in this post mostly assuming the green path would take the majority of shares and orders (aka “free and fair market”).

How would shorting work in such a market?

Here is a thought experiment on how shorting could work in such a free and fair market. Let’s say realGME was the token of the company and wrappedGME the derivative which you get instead of realGME when lending your share.

Here is a thought experiment on how shorting could work in such a free and fair market. Let’s say realGME was the token of the company and wrappedGME the derivative which you get instead of realGME when lending your share.

- If you buy a tokenized stock you would always know that realGME is the one which is a real share, always with 1:1 voting rights and 1:1 rights of 1/(shares outstanding) of the company, always.

- A buyer would therefore only buy realGME, not some wrappedGME (this is very different today with e.g. EU brokers going to EU exchanges and only offering GS2C instead of GME).

- A shortseller would then need to somehow get realGME which he needs to sell to a buyer, he could not sell wrappedGME. Yes, you could maybe fuck around with the derivative wrappedGME, but you could not with realGME - thus any buyer always gets a real share, the lender may be cheated, true. So the lender should know the risk when getting wrappedGME. Today lenders and buyers are cheated. Also the (short-term) negative price pressure on realGME would still be there. Keep this in mind for now.

- The new buyer becomes owner of the realGME with its voting and economic rights on the company attached, no one can take the realGME from him by whichever force.

- The old owner who gave his share away to shortsellers receiving a wrappedGME which only signals the ownership rights on a realGME, but losing his voting and economic rights - the old owner got a derivative, which is clear at the time.

So the ownership right is clear in every second of this transaction. This is fundamentally different than today. And now to make this system work we would need:

- wrappedGME could be provided by a smart contract which holds collateral from the short seller (e.g. ETH or some kind of USD).

- the short seller can either buy back a realGME and exchange it for wrappedGME or in case of a “margin call” the smart contract will automatically buy back realGME and do the exchange.

7b) for this to work the margin call would always be below the value of the collateral.

7c) still, in extreme situations when the price of realGME is higher than the value of the collateral a buy back is not possible. Then the old owner would lose the realGME and receive the collateral instead.

7d) we’d likely see a huge number of variants in how collateral is paid, upon which terms, etc.

In short: shorts would still pretty much work, maybe even better than today. But it forces more honesty between two people or entities making a deal.

Comparing todays short technics with those in a free and fair market

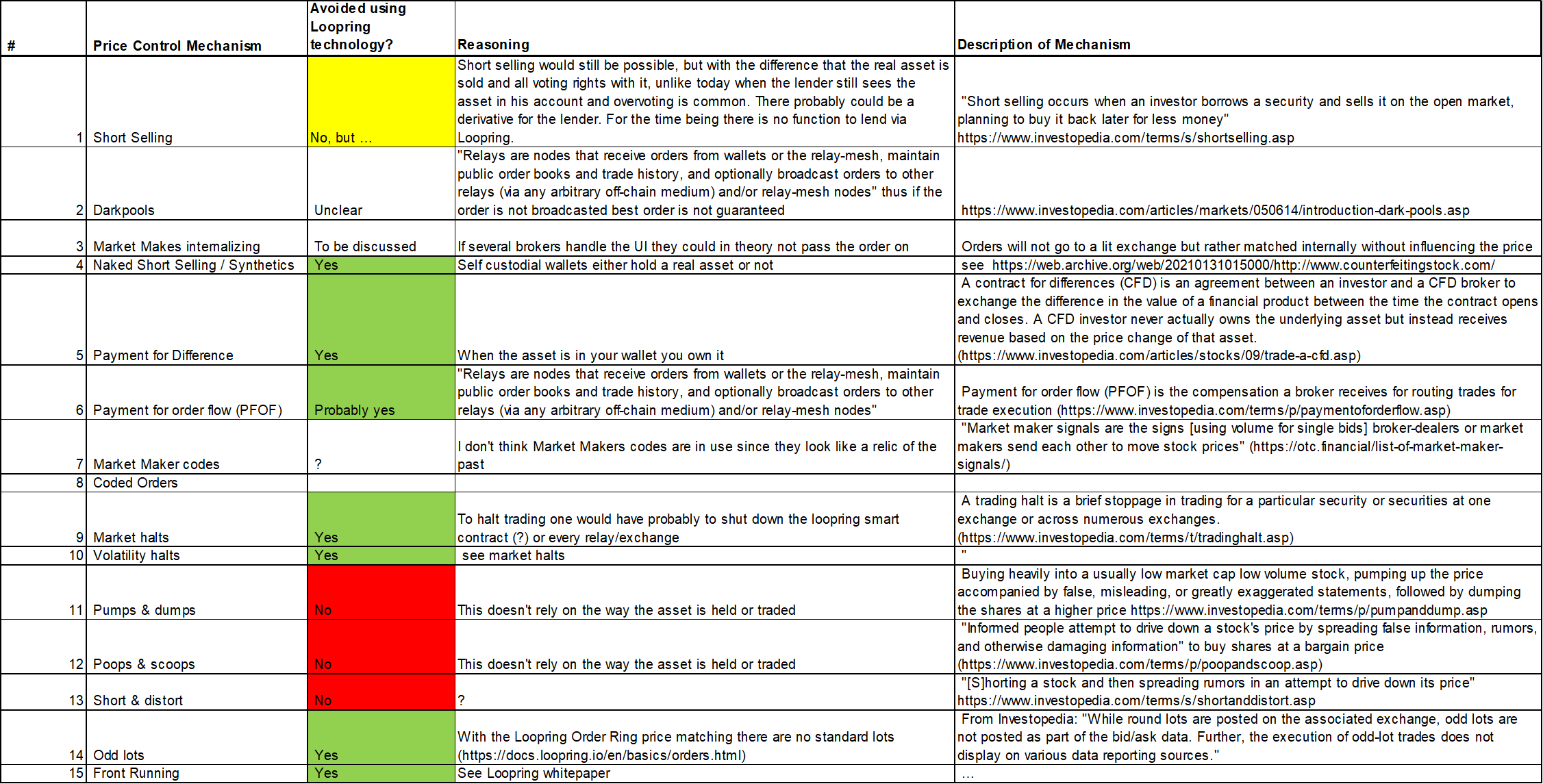

However, there are many more tactics to influence a stock price and we will dive into each and look whether the whitepaper provides a solution.

Or in short:

What is left for shorts and how can we be one or two steps ahead?

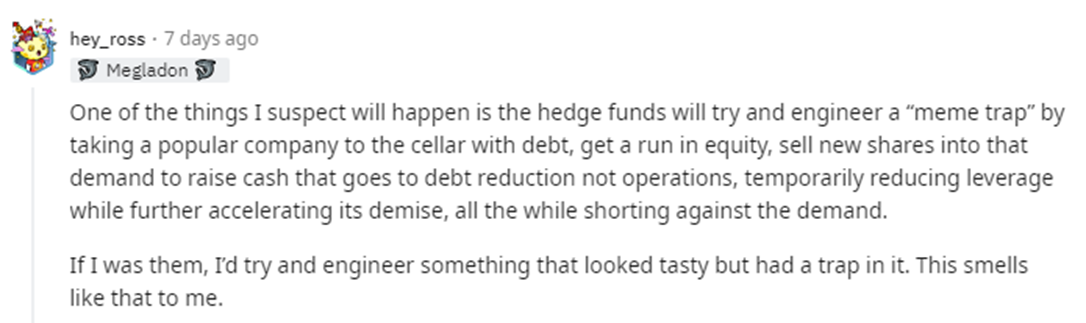

Man, such a free and fair market would be something I am really scared of if I had a lot of naked shorts in nearly every stock on the planet. This would indeed something, shorts never forget. Since its also a few years that individual investors theorized such a system for GME, there is no way shorts haven’t been doing this for some years now. And while there might be countermeasures from shorts in the political, regulatory, behavioral and so many different corners, we will just look at their usual techniques and see what’s left. So the three main things which work independently of a free and fair market are pumps & dumps, poops & scoops, short & distort. Let’s call them traps.

So if they cannot beat individual investors by their normal tactics they have to probably level up on what’s left. Ah, and make no mistake also institutional investors are being played. Don’t forget, this is a game of longs vs naked shorts.

Now, to be one step ahead, we should discuss exactly the matter of this post. We know about GME pretty well, but we can only direct register every share once, so probably the question in which stock to invest is a pretty important questions. Maybe also some might want to become activist investors themselves. Therefore, to be two steps ahead we should already begin to understand short traps (where a subset is surely “meme traps”). And I imagine this is game where we never finish learning. Let’s begin.

Sources https://www.reddit.com/r/Superstonk/comments/v20yqz/best_tldr_of_this_whole_saga_by_ujgatprime/ (I really recommend you to look through the comments of JG-at-Prime) https://web.archive.org/web/20210131131256/http://www.counterfeitingstock.com/CS2.0/CounterfeitingStock20Full.pdf https://loopring.org/resources/en_whitepaper.pdf