A buddy of mine told me about Wealthfront recently and they’re 5% money market account rates.

Growing up in a world where savings accounts and even CDs never approached more than 2%, the rates on this new thing blew me away.

Free money is great, and I’d love to take advantage of these rates, but the only cash I have currently is the emergency fund I’m trying to build.

Anyone have thoughts on if putting an efund in this kind of service is a bad idea? Not sure if it’ll be liquid enough if a major expense comes up.

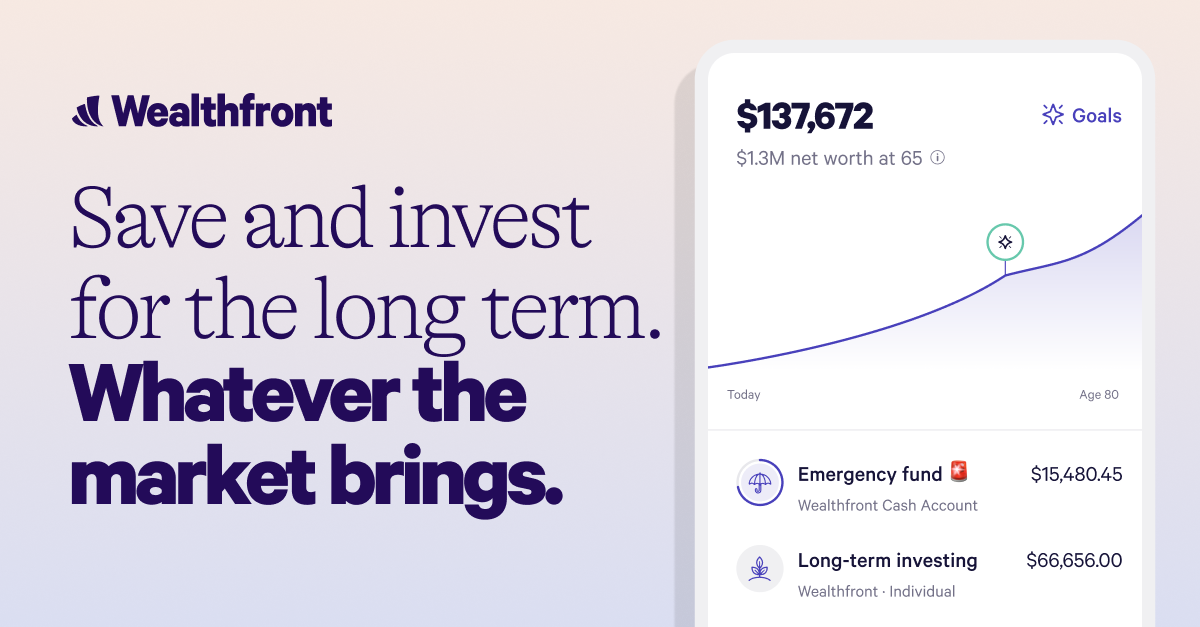

I do and actually use it as my primary checking account now. I still have my other bank accounts and transfer money if I need it. It’s earning 4.8% right now. It’s also nice that you can link it to all your other accounts (banking, investments, credit cards, retirement, etc) and have them pulled in to one place for an overall picture.