Original take found on another forum.

"I think we’re seeing the beginning of the tech bubble bursting again.

You’ve got the successful companies that provide a case study in tech industry profitability(Google, Amazon, Apple, etc.) which is why you’ve got all these venture capital firms plowing so much money into startups, left and right, because they expect that one of them will be the next Google or Amazon. Now that low interest rates have gone bye-bye, the VC firms are demanding that these startups start showing a profit. However, almost all of these startups have one of the following problems:

1.) They were never profitable and can never be profitable because the fundamental concept of what they do is thoroughly flawed

2.) The service or good they provide could be profitable, but due to being formed during a time of easy money, their current business model is incapable of being profitable, and they are too over leveraged to be able to restructure themselves into a more profitable setup

3.) They are perfectly sustainable/profitable, but their financiers expect far more return on investment than they are capable of providing

The result is the trend of “enshittification” as VC investors force unwanted changes onto these startups in the hopes of increasing revenue. This is stuff like locking previously free features behind a paywall, clogging everything with ads, cutting costs somewhere (payrolls, server space, etc) that negatively affects the user experience, raising prices, or needlessly bolting on something that nobody asked for because it’s one of the only things that VC firms might still blindly throwing money at(AI).

Even the actually profitable companies are doing this shit because they are just addicted to the ridiculous growth they’ve enjoyed in the past."

“enshittication” is actually a term coined by Cory Doctorow in this article: https://pluralistic.net/2023/01/21/potemkin-ai/#hey-guys

It’s a great read.

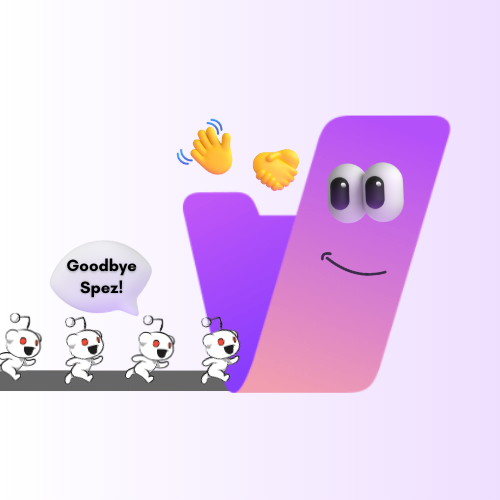

So this is why I am invested in this. Not really about the aps. I see this as stand against enshitifcation and showing that the precious ipo is not a given if you treat your users as cattle.

the stand against enshittification would be changing corporate governance to reduce the role capital plays in decision making, this is just fun. It’s also, at least for a time, a return to a more interesting internet

Isn’t choosing a platform not driven by capital basically fighting enshitification?

it is whatever you want it to be.

Thanks for sharing it. I somehow made it all the way to an end, and the insights in this article are ingenious, and so very true. It’s also eerie how these companies’ behavior is so similar to a manipulative, narcissistic, controlling sociopath that tricks people into abusive, co-dependent relationships that become very difficult to leave.

I think it’s because the people in charge of them are also narcissistic sociopaths, and that personality affects the company’s culture and works its way down into the product.

I really wish the Sherman anti-trust act were enforced more frequently and harshly nowadays, and the companies weren’t allowed to buy their competitors and become megacorps. I’m glad things like the Fediverse exist to help fight back, because we’re probably already about halfway to becoming a Cyberpunk dystopia. We’re just missing the Cyber, honestly.

The law requires the board and the top executives of any corporation to behave like sociopaths with regard to the business. They have a legal responsibility to their shareholders to maximize profits. That supersedes any responsibilities to their employees, their customers, or the general public.

In 1916 Henry Ford reduced Ford’s dividend payments to shareholders so he could increase the salaries of his employees. Some shareholders successfully sued him for it and won. He was forced to eliminate the raises and pay the higher dividends.

And we have been stuck with the inhumane results of that court decision ever since. Corporations aren’t bad by accident. They are bad by design. They are legally required to be bad. It isn’t surprising that the people who are often the most successful at making sociopathic decisions are themselves sociopaths.

Only when they go public. I’m constantly astonished at this decision making.

…which is probably an unspoken job requirement.