Russia’s central bank on Tuesday hiked interest rates by 350 basis points to 12% at an emergency meeting, as Moscow looks to halt a rapid depreciation of the country’s ruble currency.

The ruble slumped to near 102 to the dollar on Monday, as President Vladimir Putin’s economic advisor, Maxim Oreshkin, penned an op-ed in Russian state-owned Tass news agency that blamed the plunging currency and the acceleration of inflation on the “loose monetary policy” of the central bank.

deleted by creator

By comparison during the height of the inflation issue in the US the fed only hiked it 0.75% at each meeting for a couple meetings

I don’t think there’s really a comparison, but the US Fed increased the prime rate significantly more than how you worded that. They did it over a year or so depending on how you interpret the data. The rate was increased by 5%, which is more than double, from 3/22 to 8/23.

https://www.jpmorganchase.com/about/our-business/historical-prime-rate

Jokes on you I worship my central bank shrine every morning.

3.5% point*

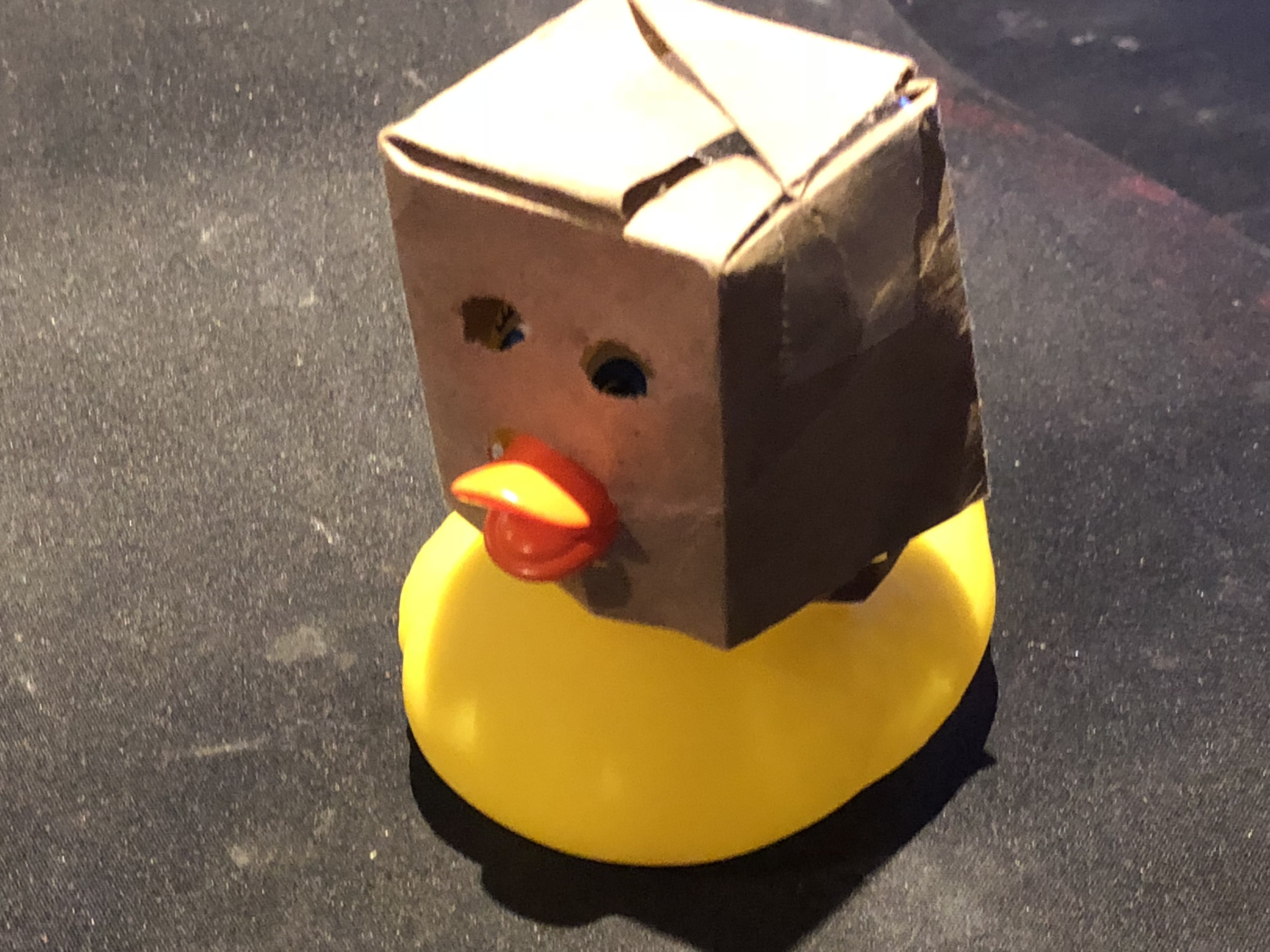

I like Polandball, I’m glad to see it for something like 15 years now :)

The solution is to beat all credit to death. Great work everyone, pub?

Am a finance student from Russia.

12% is fine. It’s a temporary measure to keep the currency at bay. It’s not great, don’t get me wrong, I’d much rather it was at 4-5% as it was in 2020, but it’s appropriate given what’s happenning with the country.

In comparison, on February 2022 it was 20%, which in simple terms saved the banking system from collapsing, our Cenral Bank is one of not that many agencies that are at least compitent.

It does slow down the economic growth, but trust me, there are way bigger problems than expensive credit when it comes to economic growth. Short-term everything is quite well, but long-term if nothing changes? Oh boy, oh boy.

I don’t follow the subject in Russian terms (the US/UK are already confusing to me) but it’s interesting to hear what other countries find normal and tolerable. I think it’d be raining men in wall street if we saw rates that high.

Last time the US had rates at a comparable level was during Volcker’s term at the Fed in the early 80s. It did successfully bring down some crazy inflation.

That said there’s been 15 years of easy money following the 08 disaster and it definitely wouldn’t be pleasant to have such rates now. Businesses and as such the broader economy are built around assumptions that things will stay more or less in familiar territory

As funny as it would be to watch the tech industry try to build cash flow positive businesses, it might just crash the global economy at this point to do so.

Low rates brought on very slim capital structures financed by corporate paper.

We would deleverage, but it would hurt returns and generally be unpleasant, plus we’d go back to corporations sitting on mountains of cash “just in case”.

Long term problem, I mean, most of the industrialized world loathing Russia and not wanting to trade at all is going to hurt much more than currency instability.

Nah, they have China, resources for rubles.

This just means they have no other option.

China isn’t really that interested in importing that much in terms of finished goods. Natural resource exports can only go so far

Asian countries dont believe in importing finished goods, they play using mercantile economics, try to figure out how to climb the value chain while fiercely protecting domestic markets.

But russia is a natural resource gold mine, and exporting them has gotten russia pretty damn far up to now.

Putin is planning to push credit out a window.

deleted by creator

Three bullets to the back of the head. A tragic suicide.

I still have no idea how credit managed to stuff themselves into a duffel bag, zipped it up and decided to hang out in that car trunk.

The credit will sip some polonium tea

And if that doesn’t work, the finance minister.

Or the poor sod that the finance minister points a finger at.

Everyone’s credit? Oh no. The tzar and his cronies are fine.

The plebs? They don’t matter. The propaganda spinners will be going to work soon.