FuckyWucky [none/use name]

Pro-stealing art without attribution

- 543 Posts

- 2.61K Comments

23·5 hours ago

23·5 hours agoShining Path

7·7 hours ago

7·7 hours agobut the deposits are still a liability regardless of whether its held in Government bonds or as reserves.

the banks need the loans as collateral to obtain reserves

6·8 hours ago

6·8 hours agoIt doesn’t even give them more leverage. They are talking about reserve requirement (customer deposits), ie they only have to keep less Government money. It gives them zero additional capacity to lend.

What you are referring to is capital requirements, which involves increases or decreasing amount/quality of assets (which are loans given to customers or its own assets). In this case banks may give more and riskier loans for the amount of assets they have.

This was what happened in 2008, banks gave out shit ton of bad loans while having little assets. They could go to the Fed and ask for loan but this (normally) would require them to give collateral which they didn’t have, in this case bank would have to be shut down, nationalized or bailed out.

Reserve requirements wouldn’t have prevented this, better enforced capital requirements would have. That’s why Basel norms was all the talk back then.

Fed capitalized the banks unconditionally while the banks provided fed with next to no collateral.

42·13 hours ago

42·13 hours ago

PBOC really needs a purge, filled with Neoliberals who believe in loanable funds bs. Lowering reserve requirements has never made any difference, it doesn’t free up money for lending.

Even if it was assumed lowering reserve requirements would “free up” money for lending, what if people don’t want a loan? What if they think they won’t be able to pay back? What if they think the interest rate is too high and are waiting for lower rates?

No teeth. SAD

4·14 hours ago

4·14 hours agoThey doing more against piracy than CSAM lmao

1·1 day ago

1·1 day agodeleted by creator

8·1 day ago

8·1 day ago

get out of my feed

. ik Ukraine is based wholesome epic chungus 100 while Russia is evil Putler 100 million dead. i’ve watched that boyboy vid and its a bit too balanced.

. ik Ukraine is based wholesome epic chungus 100 while Russia is evil Putler 100 million dead. i’ve watched that boyboy vid and its a bit too balanced.

60·1 day ago

60·1 day agoits an ip grabbing site almunked dot com.

made by IDF for ‘informing’ almunked = the savior btw

6·1 day ago

6·1 day agoThe Diamond Arm is my fav

12·1 day ago

12·1 day agoConsidering they also buy tanks from Russia like the T-90, I doubt there will be any direct exports. The amount of its arms India allowed European countries to export to Russia is still minimal.

‘Not good’ countries these will reach include Myanmar.

9·1 day ago

9·1 day agoRead theory, folks

spoiler

Cw: Mark Robinson’s hornyposting

18·2 days ago

18·2 days agoI don’t think the current anti-mask “back to normal” sentiment is in any way “western”. It’s very much global outside Japan (and maybe a few other countries). Not many ppl worry about covid anymore and unless there is state willingness and proper enforcement of masks that isn’t going to change.

6·2 days ago

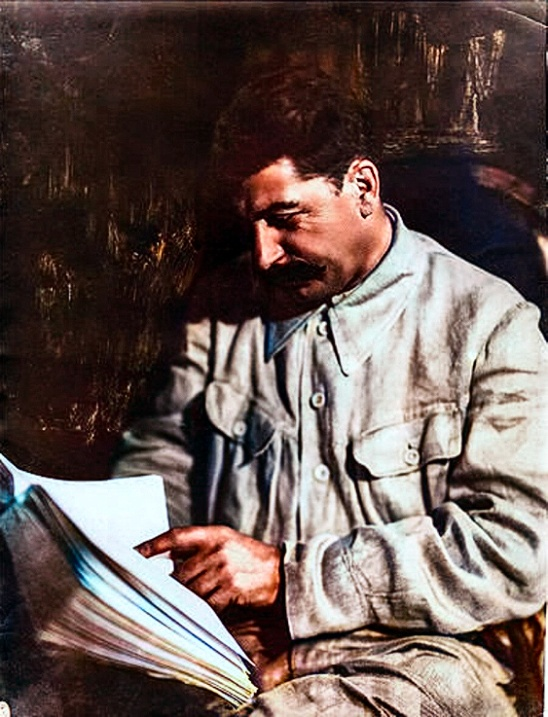

6·2 days agoMany of them were small business kulaks

https://www.inc.com/inc-staff/capitol-insurrection-business-owners.html

28·2 days ago

28·2 days agohis mistake getting such a shit truck

it was interesting to watch, he doesn’t sound very different from modern fascists. I know