Правда?

Правда?

But this user plans to leave ping running all the time to check that their own Internet connection is working.

Either way, at any given time there’s tons of traffic leaving your network, it just means that software is active, not that a human is active. On top of that, Cloudflare probably isn’t selling the fact that an ICMP ping was received at their DNS server directly to spammers quickly enough for them to act and put an email at the top of your inbox, assuming that spam isn’t caught by a spam filter first.

FPS are an adventure/puzzle game where the only solution is “USE GUN ON MAN”

If the other traffic is already correlated to your IP, then what additional info does an ICMP echo leak?

ICMP doesn’t reveal any personal details. As opposed to say when you visit with the web browser where you can be fingerprinted, and perhaps have that tied to the rest of your browsing history or real world identity.

You make it seem like the US’s market will need to experience the same thing eventually.

You make it seem like it didn’t already: The US market didn’t reach its 1929 peak again until 1954. 25 years is a long time to hold out on withdrawing your retirement investments.

Here’s two other modern markets:

The Athens Stock Exchange had peaks in the 2000’s that haven’t recovered.

Ukraine’s stock market has ceased operations since the invasion.

These events are rare, but not unheard of.

At least as close as anything can be guaranteed in this world

Turns out “close to guaranteed” is in fact, not “guaranteed.”

So much so that if you pick any 25 year period over the last 200 years, you won’t find a single instance where the total value of the all traded stocks was worth less at the end than at the start.

Here’s my 25 how did they do:

(hint: they’ve all filed for bankruptcy at some point)

Again, look at the Nikkei from the 1990’s - that’s an entire index that was flat for 30 years. Hard to put off retirement for 30 years waiting for that index fund to pay off.

Don’t bother dying on this hill, son, there’s plenty of other, nicer hills to die on.

It becomes gambling when you are going on gut feelings without researching what you’re doing.

If you have an investment strategy that financial advisors approve of, let’s say investing 70% in a US index fund, 20% bonds and 10% high risk mutual funds that you don’t touch for years or decades, that’s investing.

If you’re just randomly picking stocks, buying and selling in order to make a quick buck because of some guy screaming at you on television without any real research into a company other than a few google searches, that’s gambling.

I want to remind everyone that there is no guarantee that the market / index funds continue to go up. It hasn’t happened in the US market, but look at the Nikkei over the last 30 years - if you had invested in the 90s you would only now be getting some of your money back - that is a long time.

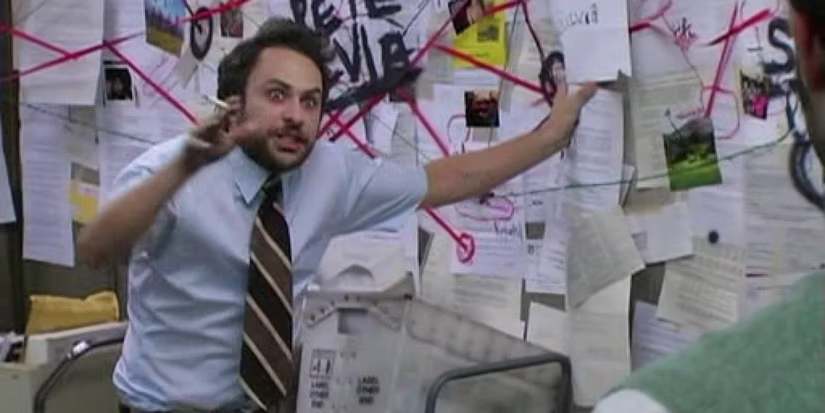

to be clear, I’m not saying you’re wrong, just can’t help but see this in my head.

BOFH: hooked up the mains to the doorknob and asked a luser to bring their laptop over for personal attention and repair.

Most potent toxin known to science

…so far.

Kelis, her frozen dairy drink desirable.

Midjourney is a good alternative that renders 4 images when you feed it a prompt

dmesg | less should allow you to scroll the output. You should use forward slash in less to search for the devices (hit enter), see if the modules are being loaded or if there some errors.

Shaka, when the walls fell

(this message intended for jim bowie only)

you gotta buy the furniture but the house is free

check lsmod before and after see what kernel modules are changing.

also look at dmesg for interesting kernel messages as you attempt to use / not use the offending hardware.

I’d like to remind everyone of the “vampire effect” of wall-wart chargers - if you just leave them plugged into the wall waiting for you to connect a device, you’re constantly wasting a bit of electricity. That should also be involved in the efficiency decision of using the already plugged in computer or laptop.

Charlton Heston Bonus Round: