If you listen to Canadian politicians, the solution to our housing crisis seems to be some combination of immigration reform and a herculean countrywide building effort.

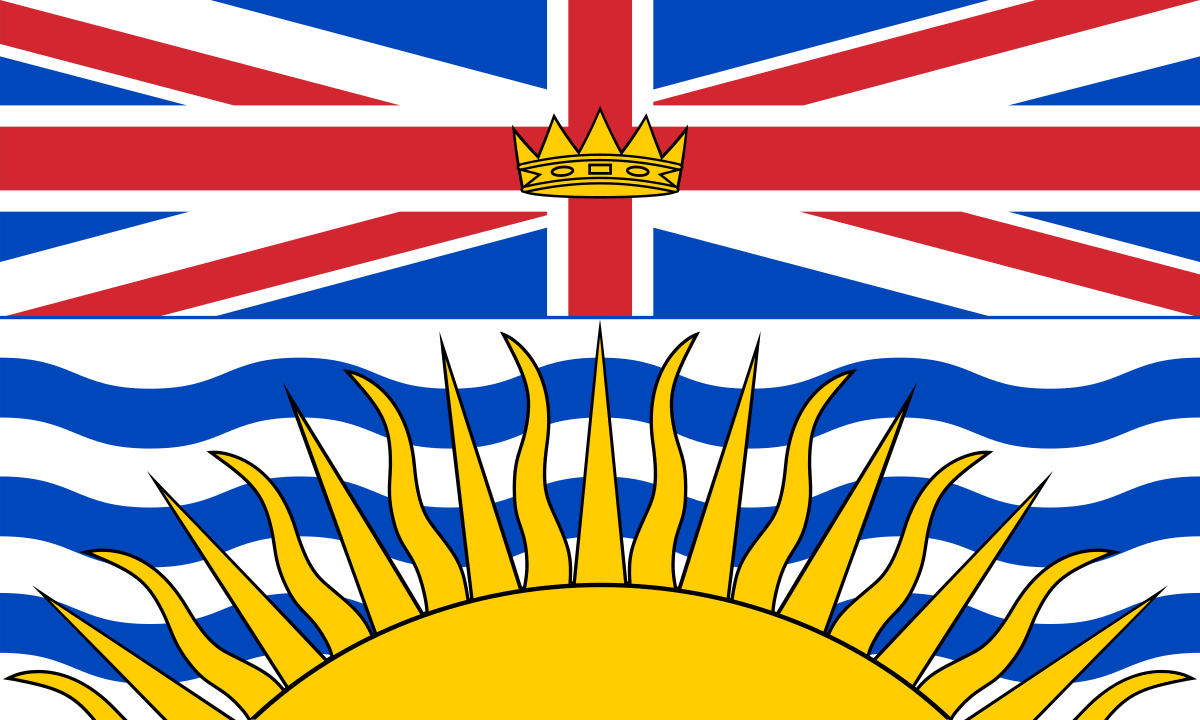

But Paul Kershaw, a public policy professor at the University of British Columbia and founder of the affordability advocacy group Generation Squeeze, says the emphasis on increasing housing supply obscures an issue politicians are less likely to address.

Namely, that we, as a country, have become addicted to ever-rising home prices, largely because we’ve been conditioned to see our homes as financial assets.

“There are multiple things we need to do [to reduce prices], and more supply is one of them,” said Kershaw. But funding announcements for building projects are a “way to organize our concern about the housing system so that we don’t have to … look in the mirror — particularly homeowners who have been homeowners for a long time — and say: ‘How are we entangled?’”

He said the current system incentivizes extracting profit from real estate, rather than prioritizing that everyone has access to affordable shelter.

“We need clarity about what we want from housing,” said Kershaw. “And it has to start with: ‘We don’t want these prices to rise any more.’”

Housing should not be an investment. In Japan they aren’t. In fact, they’re depreciating assets and they’re doing just fine.

“Fine” is a bit of a stretch.

The average unit size per person is absolutely tiny, North Americans would revolt if that was what was available here outside of the downtown cores of cities. Detached 3 bedroom houses in Japan are usually only 50-70 square meters (540-750 square feet), 2 bedroom apartments at 400 square feet are common.

These detached houses often come on lots of 300-400 square feet, with no yard since it literally takes two levels to hit 750 square feet even with 100% land footprint.

I’m not saying Japan is bad, but they have a lot of their own economic and mental health problems caused by work life balance and housing.

Tl;dr The average American wouldn’t fit in a standard Japanese bathroom.

That’s due to space restrictions. Japan has a lot less space than the US does, especially if you want to live in a large city. That’s not the case in the US. The point is, it’s not the size of the housing that makes their real estate depreciating assets.

What does Japan do to make it a depreciating asset then?

Looks to be technological advancement due to earthquake resistance, an abundance of supply and low property taxes.

The abundance of supply is really easy with a declining population. It also stalls your economy and causes a ton of other social problems.

Japan real estate was a massive appreciating asset back in the 80s when the population was increasing.

Tech advancement regarding earthquakes shouldn’t have any significant impact. It’s not the building that appreciates, it’s the land.

If anything, low property taxes make it a better investment. Reccuring costs reduce profit.

So while you’re kinda right with the supply situation, it doesn’t help sort our the problems here.