US consumers remain unimpressed with this progress, however, because they remember what they were paying for things pre-pandemic. Used car prices are 34% higher, food prices are 26% higher and rent prices are 22% higher than in January 2020, according to our calculations using PCE data.

While these are some of the more extreme examples of recent price increases, the average basket of goods and services that most Americans buy in any given month is 17% more expensive than four years ago.

If you want to know why Americans are bummed out about their purchasing power, just look at this chart about how wages abruptly stopped increasing with productivity 45 years ago. People are accomplishing more than ever before in history and being left with less buying power. In many cases wages don’t even keep pace with inflation because companies pay based on what they can get away with, not what the work is worth.

I could work two hours a day and still get all my tasks done. I could do that, go to my next job, and do another two hours of work and double my income. But because I have to have my butt in a chair in an office eight hours a day on the off chance my boss thinks of something additional for me to do, I’m stuck being four times more inefficient than I need to be.

This is the answer. For 50 years now wages have remained stagnant while productivity has gone up through the roof. We are being robbed decade after decade, and by now claims of “strongest economy” feel like slaps in the face. Many of us are earning more than ever before, yes, but also have less purchasing power than ever before.

Remember that in the 1950s a high school grad could support a family of 4 with a house and car on a single income. That’s how much has been taken from us by the rich and corporations.

Except that doesn’t explain how as soon as there’s a Republican president, people suddenly think the economy is great.

Productivity and wages aren’t intrinsically linked.

Say you’ve got someone digging a trench with a manual shovel, and then the Bobcat is invented. Let’s say that the Bobcat lets someone do five times as much digging. The wage paid isn’t going to be five times the shoveler.

The wage will be set by whatever it takes to get ahold of someone who can operate the Bobcat. That’ll depend on how many people are out there who can operate a Bobcat, and what else they might be doing.

The only guarantee is that it won’t be more than five times the manual shoveler, because then (setting aside, for a moment, the non-labor costs) digging the thing with the Bobcat would be less-efficient than having it manually-shoveled.

In fact, productivity and wages can be inversely-correlated.

Let’s say that instead of a Bobcat operator and a manual shoveler, where the skillset is different and the pool of people who can do each may differ, you have some technological improvement that doesn’t change the pool of labor at all. Let’s say that someone suddenly realizes that the Bobcat shovel could be twice as large and it can scoop twice as much. Ignoring, for simplicity, things like setup time, suddenly every Bobcat operator is twice as productive.

Now, usually there’s some level of price elasticity of demand. If you can make something more-cheaply, then more people will buy it – some people wanted a trench but it just didn’t make financial sense, but now suddenly it does. But let’s assume that demand is entirely inelastic. There is still the same amount of demand then, even if the trench can be dug more-cheaply, and the same amount of trench will be dug.

In that case, one only needs half the number of Bobcat operators. The market allocates workers based on their wage – pay more, more people will be willing to do a job, pay less, and fewer will. What will happen is that Bobcat operator wages will drop until about the required number of Bobcat operators are willing to do the work. Those who were already on the edge will exit the field, do something else.

Wages can also change when productivity doesn’t. North Dakota had an oil boom about twenty years back. There weren’t nearly enough people to work the fields. Wages skyrocketed, and people entered the field or moved to the area. They weren’t more-productive than the previous workers. They were paid more because the supply was limited; paying more resulted in the needed number of workers showing up.

Wages can closely track productivity in some situations. Suppose you have zero price elasticity of supply – that is, no new workers are able/willing to enter a field, no matter what wage is being offered. And there is infinite price elasticity of demand – in practice, immense demand for the thing at the particular price, but not above that. An example – maybe a bit contrived – would be if a number of people with identical cars all locked their keys in their uninsured cars prior to a flood, and a lone locksmith is available. They can break a window to get their keys and rescue their car, or have the locksmith open the car. Anyone who can will pay the locksmith to open the car for up to the cost of replacing the window, but not more than that. There is no time for more locksmiths to show up – supply is inelastic. In that case, if the locksmith could manage to open a car in half the time, he’s be paid twice as much.

But normally, wage serves the role in a market of allocating workers to a given field. It isn’t directly bound to productivity. And you wouldn’t want it to do that, because that’d kill its use to do that labor allocation, which is how the market moves workers where they’re needed. Let’s set aside practical difficulties and imagine that we could pass a law to lock productivity and wage. Suppose it resulted in a lower wage than market rate – as it would with the North Dakota oil workers above – then you wouldn’t have enough workers, and oil that should be extracted would go unextracted. Suppose it resulted in a higher wage than market rate, as it would with the Bobcat operator above. Then you’d have a line of capable-of-using-a-Bobcat people, all of whom want the Bobcat operator’s job. In practice, because the wage is locked, non-wage compensation probably changes – that is, the conditions of the job get worse. The Bobcat operator has to be on-site the instant the job starts, any mistake on his part and he’s immediately replaced, etc. And you have the crowd of people trying to get his job probably trying to offer bribes and the like to get him ejected and themselves put in place.

Disclaimer: I don’t have a degree in economics. I read your post and I think I have countering points to make, but if you can rebut my points below specifically I’ll try to listen. (Also just want you to know I’m not the one who down-voted you since you seem to be arguing in good faith and I’m all about that. Sometimes I’m wrong.)

-

You talk about making things more cheaply and that resulting in a cheaper product. If companies agree to all charge the maximum they can get away with, it kills industry price competition (a foundational necessity of functional capitalism) and renders price elasticity a falsehood. If Coke and Pepsi both charge 1.50 for a can of cola, it doesn’t matter if increased productivity means Coke can make a can for 20 cents instead of 30 cents - the savings are just converted into extra profit. You can see this in record profits for many sectors as productivity has increased - the savings of needing fewer people to do the same work isn’t passed on to customers. As proof, here’s an article about how much more things cost today than in the 1970’s (adjusted for inflation). Yet we know that people are over 3x as productive per person over the same period, so clearly companies are not passing along savings in the form of cheaper goods. I know more than productivity affects price, but those factors would have to be overwhelmingly more costly to justify the increase and I don’t think things like shipping are that much more expensive.

-

Inelastic demand for necessary products like fuel, utilities, food, health care, etc also means that in many industries increased productivity does not need to translate to savings. Pharmaceutical companies, either as an industry of multiple providers or where they hold exclusive patents, will raise prices of products to whatever they can get away with because people will either pay or die. So again cheaper products and competition is a myth.

-

Speaking of getting fewer people to do the same work, companies lay off people all the time when individual productivity or automation goes up. You talk about employing 1/5th the Bobcat workers and net lost 4 workers being forced to find other work. This may make economic sense but it’s terrible societal sense. It results in financial insecurity and homelessness among educated, capable people with all the associated national problems like mental health, crime, drug addiction, etc.

-

As US economics function now, companies do not pass along the value of increased productivity to their customers in savings, nor to their employees in increased wages, shorter work weeks, or stable employment (re: layoffs). Instead they maintain or raise prices depending on what they can get away with and employ as few people as possible to maximize profit. This has the societal consequences we’re seeing now, such as in OP’s article.

This long explanation supporting capitalism and ‘the market’ fails to take something crucial into account that all these market promoters forget:

Labor cannot have an undistorted market so long as the option to not sell your labor isn’t a valid one.

For any market to be relatively undistorted, a seller must be free to choose not to sell at all if none of the offers are equal or greater than her assessment of the value of her product.

However, as long as labor is needed in order to procure food, shelter, and adequate living conditions, this cannot be the case - people are coerced into selling their labor at values lower than their assessment of its value because to not do so means being denied adequate living conditions.

If people were free to choose not to sell their labor without this coercion, then those seeking to purchase people’s labor would find they likely cannot find anywhere near as many people willing to sell at the price they are offering.

Basically, you are making excuses for the fact that due to this market distortion coercing people to sell their labor, the divide between productivity and wages has grown. It is not necessary to lock wages to productivity - if people have the option, and they see massive profits being pocketed off their work with increasingly minimal compensation, they would choose not to sell…except there comes the coercion to ensure they don’t do that.

I wonder if the same excuses would be made if we turned it around and told companies they must sell their products, no matter how little the customers are offering…

deleted by creator

You talk about making things more cheaply and that resulting in a cheaper product. If companies agree to all charge the maximum they can get away with, it kills industry price competition

Sure, if all companies in a market formed a cartel and engaged in price-fixing, and it wouldn’t be a competitive market.

and renders price elasticity a falsehood.

In a situation like that, you’d still have price elasticity of demand working the same way – that’s on the consumer – but supply could be artificially-constrained by the cartel to be lower than would normally be the case.

If Coke and Pepsi both charge 1.50 for a can of cola, it doesn’t matter if increased productivity means Coke can make a can for 20 cents instead of 30 cents - the savings are just converted into extra profit.

Sure, if they form a cartel, you don’t have a competitive market. Note that I would guess that the soft drink world is probably not an easy one to create a cartel in, because it’s probably not that hard for a competitor to enter – there are a number of store brand colas – but there will be products where it’d probably be easier – say, airliners or something like that.

You can see this in record profits for many sectors as productivity has increased - the savings of needing fewer people to do the same work isn’t passed on to customers. As proof, here’s an article about how much more things cost today than in the 1970’s (adjusted for inflation).

I don’t think that the article is saying that all things do – they’re giving examples of some things that do. They give four examples:

The first is homes. Homes do cost more, but I would be surprised if that is due to formation of a cartel of homebuilders – there are a lot of homebuilding companies, and cartel formation is harder the more companies are in a market.

googles

So, okay. Why do houses cost more?

That one I have looked at before.

They actually don’t, or at least not much.

House prices are higher. But they aren’t for the same houses – new homes have gotten substantially bigger. If you want an apples-to-apples, you want to look at how the same home changes. The Case-Shiller index tracks repeat sales to eliminate this as a factor. Someone’s graphed this (the red line) since 1974 and put CPI up, to account for inflation (the black line).

The long run trend since the 1970s is to follow inflation fairly-closely. What you see there are instead two large “surges” – and we are in the middle of the latter. The first was during the runup to the financial crisis, when a lot of money was lent out and drove a bubble. After that popped, about 80% of the increase in house prices since 1974 was due to inflation.

There’s been a new surge since then, which started with the COVID pandemic. The Federal Reserve held interest rates down during the pandemic to avoid a recession. That made it cheaper to borrow money, so a lot of people borrowed more and more and bid up house prices. But that’s a short-term thing, not a since-the-1970s trend.

Here’s an article from the Fed back when the surge started talking about it.

The second is college tuition.

Similarly, I think that it’s pretty safe to say that all the universities and colleges out there have not formed a cartel, as they’re a lot of them out there, and it’d be pretty difficult to do.

I haven’t looked at this one before, a quick google makes it look like this is may be something of the fact that they’re measuring “sticker price”, not what people actually pay.

The way universities work, there’s an advertised price, which is the highest price that anyone pays. Then there are various forms of financial aid, which reduce the actual amount that an individual pays; typically, this is need-based aid, where poorer students pay less.

Looking at this, it looks like what’s happened is that government subsidy directly to universities has fallen off…but aid to students has risen. The former doesn’t contribute to the advertised tuition price (the university gets money directly, doesn’t need tuition money) but the latter does (the student pays tuition but then gets financial aid).

googles

Yeah. Apparently that was part of a shift from state-level subsidy to federal-level subsidy:

States and the federal government have long provided substantial financial support for higher education, but in recent years, their respective levels of contribution have shifted significantly.[1] Historically, states provided a far greater share of assistance to postsecondary institutions and students than the federal government did: In 1990 state per student funding was almost 140 percent more than that of the federal government. However, over the past two decades and particularly since the Great Recession, spending across levels of government converged as state investments declined, particularly in general purpose support for institutions, and federal ones grew, largely driven by increases in the need-based Pell Grant financial aid program. As a result, the gap has narrowed considerably, and state funding per student in 2015 was only 12 percent above federal levels.[2]

This swing in federal and state funding has altered the level of public support directed to students and institutions and how higher education dollars flow. Although federal and state governments have overlapping policy goals, such as increasing access to postsecondary education and supporting research, they channel their resources into the higher education system in different ways. The federal government mainly provides financial assistance to individual students and specific research projects, while states primarily pay for the general operations of public institutions. Federal and state funding, together, continue to make up a substantial share of public college and university budgets, at 34 percent of public schools’ total revenue in 2017.

Hmm. That’s probably advantageous; one of the few things that I think that the US has probably done wrong from a policy standpoint is having a good deal of educational subsidy still be local rather than federal, as it creates problems if people are educated in one place and then move to work in another. That’s a very serious problem in the European Union, and while the US has more-centralized subsidy, still a lot was non-federal.

But I’ll say that I haven’t looked to dig into college costs changes over time before, the way I have housing, so this is an off-the-cuff take. But if it is an artifact of a shift to federal subsidy, I’d probably say that it’s a good thing, fixing a problem that was present in the past.

Let me continue going through your comment in a child comment, so this doesn’t get too long.

@GrymEdm@lemmy.world

Okay, the next one is healthcare costs, which they say have risen by about 50% by their metric since 1972. So, I haven’t dug into that, but there I could believe that you might legitimately have the sort of cartel you’re worried about. Well, okay, not a cartel, but regulatory capture. A doctor can only practice in a state if the medical board approves, and doctors can influence the standards set by the medical board – that is, block out competition, something that most industries can’t do. Doctors do make pretty high salaries in the US, much higher than in many other countries, and I’ve read articles before that are pretty critical of the role that the regulatory system places in creating the barriers to entry.

https://www.economist.com/united-states/2023/10/31/why-doctors-in-america-earn-so-much

Why doctors in America earn so much

According to the Association of American Medical Colleges (AAMC), in a decade America will have a shortage of up to 124,000 doctors. This makes no sense. The profession is lavishly paid: $350,000 is the average salary according to a recent paper by Joshua Gottlieb, an economist at the University of Chicago, and colleagues. Lots of people want to train as doctors: over 85,000 people take the medical-college admission test each year, and more than half of all medical-school applicants are rejected. And yet there is a shortage of doctors. What is going on?

Yet there is another explanation for the doctor shortage, which has to do with the pipeline into the profession, and which the American Medical Association has played a part in creating. It takes longer to train a doctor in America than in most rich countries, and many give up along the way. Future physicians must first graduate from university, which typically takes four years. Then they must attend medical school for another four years. (In most other rich countries, doctors need around six years of schooling.) After post-secondary education, American doctors must complete a residency programme, which can last from three to seven years. Further specialist training may follow. In all, it takes 10-15 years after arriving at university to become a doctor in America.

If the expense and length of the training were not off-putting enough, the number of places in the profession has also been artificially held down. In September 1980 the Department of Health and Human Services released a report warning of a troubling surplus of 70,000 physicians by 1990 in most specialties. It recommended reducing the numbers entering medical school and suggested that foreign medical-school graduates be restricted from entering the country. Despite the shortage, doctors trained abroad must still sit exams and complete a residency in most states regardless of their years of experience.

Medical colleges listened, and matriculation flatlined for 25 years, despite applications rising and the population growing by 70m over the same period (see chart). In 1997 federal funding for residencies was capped, forcing hospitals to either limit programmes or shoulder some of the financial burden of training their doctors. Some spots have been added back, but not nearly enough. Many potential doctors are being shut out of the profession. “Not everyone who would be willing to go through that training and could do it successfully is being allowed to,” says Professor Gottlieb, the economist.

Nurse practitioners and physician assistants have been given responsibilities typically reserved for doctors, such as writing prescriptions. Foreign-trained doctors have filled some of the gap too. Yet the shortage persists. This looks a lot like a labour market that has been rigged in favour of the insiders.

So I’ll grant that in that case, we may legitimately have a non-competitive market producing an increase in prices.

Next one is the price of a car.

1972: $26,100

2022: $48,200

So, I think that there are a couple factors that you can look at here. The first – and here, the article specifically talks about it – is that this isn’t a like-for-like comparison, kind of like what I mentioned with housing. If people want to spend more on a car, that can mean that there are more people buying fancy, luxury cars, not that the car has become unaffordable. They do mention the Corolla as a baseline, which is more-or-less what I would have done, and adjusted for inflation. They do say that it’s about 30% higher, but also point out that the 1972 vehicle is not really equivalent to the 2022 vehicle, as the 2022 vehicle has a lot more hardware and features.

They don’t mention it, but I’d also point out that they were measuring this in 2022; during the COVID-19 crisis, there was a severe shortage of chips to automakers, which dramatically constrained supply and idled a lot of production, and while I wasn’t paying attention to the prices of new cars, I assume that they spiked then. I do know that the price of used cars spiked as a result.

So, I won’t run the numbers there, but I think that I’d want a stronger argument with some numbers for a cartel, if that’s the concern. I’ll grant that automakers are few enough that I could legitimately believe creation of a cartel (and you can definitely point at cases where cartel behavior has shown up, as with Dieselgate in the European Union, where automakers colluded not to offer large urea tanks).

Oh, and it looks like I counted incorrectly – there’s a fifth one:

Vacation (admission to Disney World) 1972: $1,170 for a three-night/four-day stay at Disney World for two adults and two kids 2022: $2,670 for the same

Ehhh. Okay. This is not something that I’ve looked at before, but I’m not sure that Disney World – a single business – is representative of vacationing in general. I’ve watched video from Disney World, and my vague impression is that Disney World, at least today, is somewhat-upscale. They didn’t have all the resorts and stuff that they have today.

googles

Yeah, it sounds like they’re offering a more-elaborate experience than in the 1970s:

https://mickeyblog.com/2021/02/05/looking-back-at-walt-disney-world-during-the-1970s-part-ii/

As a reminder, it only consisted of one theme park, one mediocre water park, Discovery Island, and an outlet mall at the time [1979].

I’d think that maybe something like…hmm…airfare plus hotel fees plus restaurant meal costs at popular vacation spots might be a better metric, maybe?

Yet we know that people are over 3x as productive per person over the same period, so clearly companies are not passing along savings in the form of cheaper goods.

So, you’re thinking “well, if productivity rose, labor costs are an input, and there’s a competitive market, then we would expect to see price drops”?

Well, some things have also dropped; I mean, you’re looking at a list of things that’s cherry-picked to find increases. A personal computer, a flight on an airplane. I’d guess that energy prices are probably down since the 1970s:

googles

Yeah, in inflation-adjusted terms:

https://www.usinflationcalculator.com/inflation/electricity-prices-adjusted-for-inflation/

Productivity increases aren’t evenly spread across all sectors. You wouldn’t expect to see a productivity increase in one field directly translate into a price decrease, even in a competitive market, in another.

Let’s see if we can find something talking about productivity on a sector basis.

https://www.mckinsey.com/mgi/our-research/rekindling-us-productivity-for-a-new-era

So, this has a graph measuring 2005-2019 productivity growth by sector. The worst-ranked sector was construction, where productivity dropped at a compound annual growth rate of -0.9%. In information technology, productivity rose at a compound annual growth rate of 5.5%.

And to just grab those two as an example, I think that that’s probably not wildly out-of-line with what we’ve seen. Housing prices have risen a bit, based on the data I covered in my parent comment. Software’s generally cheaper than it has been in the past.

The author claims that there’s a fair bit of correlation with the degree to which a given sector was impacted by the advent of computers. I could believe that; Moore’s Law dictated that, for much of the 20th century, we saw exponential growth in transistor density, and any field that could benefit from more computing power had a factor that was exponential affecting it. That tailed off in about 2003, though, and performance improvements in computing since then have in significant part been in parallel computation, which isn’t exactly a drop-in improvement for everything the way serial computation is.

Inelastic demand for necessary products like fuel, utilities, food, health care, etc also means that in many industries increased productivity does not need to translate to savings.

Inelastic demand for something (and I assume that you’re not talking about the labor market, as I was, but rather what the industry produces) doesn’t entail that an increase in productivity doesn’t cause the price to drop. It’ll mean that as the price falls, no more of the thing is sold, but as long as the market is competitive, one would expect to see a price fall off.

I’ll continue in the child comment.

@GrymEdm@lemmy.world

Pharmaceutical companies, either as an industry of multiple providers or where they hold exclusive patents, will raise prices of products to whatever they can get away with because people will either pay or die.

So, you’re correct that a patent grants a (limited-term) monopoly, and in the presence of a monopoly, you don’t have a competitive market. Generic drugs are competitive, but ones still under patent protection – I believe that a pharmaceutical patent lasts as long as an ordinary utility patent, 20 years – aren’t. Is that good or bad? Well, the concept of having a limited period of monopoly to fund the fixed R&D costs of producing new things has been a pretty long-running convention. The funds are going to have to come from somewhere. That model has drug users pay the price for the first 20 years, at which point you have a competitive market that drops down towards cost of production. Is that a good model? Well, it means that one has to wait 20 years for competitive prices. On the other hand, it has funded the creation of drugs, and the money will need to come from somewhere (or else the users will die). Should there be a different model? I mean, there could be. But one way or the other, the money would still have to be coming from somewhere. The government could tax and provide subsidies to pharmaceuticals. Sometimes that has happened – with the COVID-19 vaccine, for example, everyone paid for it and the government paid for everyone to take it, since it impacted everyone else.

So again cheaper products and competition is a myth.

I mean, they aren’t going to be seeing competition for 20 years after invention, sure, but they do after that. If you want to say “competition takes some time to show up after invention”, I’d agree with that, but I think that saying that it’s a myth is kind of over-broad.

Speaking of getting fewer people to do the same work, companies lay off people all the time when individual productivity or automation goes up. You talk about employing 1/5th the Bobcat workers and net lost 4 workers being forced to find other work. This may make economic sense but it’s terrible societal sense. It results in financial insecurity and homelessness among educated, capable people with all the associated national problems like mental health, crime, drug addiction, etc.

Yeah, any economic change – technological, changes in trade, changes in education, etc – is going to tend to produce disruption, shift workers around. But what’s the alternative? I mean, this is broader than just questions of wage and productivity. Let’s say that you legitimately don’t need, oh, a bunch of farriers any more, because now people are using cars instead of horses and don’t need their horses shoed. I mean, one can’t just freeze the economy, or the world would look like it did whenever one froze the economy. Photography impacted portrait painters, television impacted theater actors, electronic computers impacted human computers, farm machinery impacted fieldworkers, telecommunications impacted postal workers. But…that impact has to happen if one is to realize the benefits of those technologies.

Should wages should be used as the mechanism to allocate workers? Well, the benefit there is that the people who most want to stay are the ones who do. You can have a command economy, and you have that oil boom in North Dakota, and oilfield workers are needed, and you could have the government say “you ten people go to work in North Dakota or you go to jail”. If you use wages as the mechanism to determine who goes, then it winds up being the individual workers deciding for themselves who wants to enter or leave an industry; that will filter based on how those people actually feel about the industry.

There are things that maybe we could do to improve re-entry into the workforce, even given labor reallocation. We have tried government-subsidized retraining programs, and my impression is that we haven’t had phenomenal success. Maybe it’s possible to have more-effective retraining.

Some of it is labor mobility, the ability of someone to move from an area with low demand to an area with high demand.

It might be that homeownership is a negative for labor mobility; it’s harder to move if one also has to sell and buy a home. Some countries, like Germany, have a much higher rate of renters. That could provide some other benefits; people who work in an area seeing population outflow tend to get hit both by layoffs and declining house values. But I think that many people like owning their house, and that seems like a pretty substantial shift.

It’s harder to move if you have a multigenerational household, but we’ve generally already moved away from those.

Remote work might help, for some fields. Not every field can do that.

As US economics function now, companies do not pass along the value of increased productivity to their customers in savings,

I don’t think I agree with that as a broad statement. I think that you can find areas – and you’ve mentioned some, like drugs that are still under patent where there are not competitive markets, and there, sure, that won’t happen. But in a competitive market, decreases in input costs – labor or any other – will tend to translate into reduced prices. I don’t think that it’s reasonable to say “the economy as a whole consists of cartels”.

nor to their employees in increased wages, shorter work weeks, or stable employment (re: layoffs).

Sure, I’d agree with that – there’s no direct link between productivity and wages, work time, or avoiding layoffs.

Instead they maintain or raise prices depending on what they can get away with and employ as few people as possible to maximize profit.

So, I don’t think that it’s realistic to freeze the economy in place. When the environment changes, for technological or other reasons, one is going to have to reallocate workers. You can maybe argue that we could provide greater retraining subsidy or something like that, maybe in some cases slow the rate of change, but I don’t think that just not changing is a realistic solution. In a world where the environment changes, there are going to be people who are gonna have to stop doing what they were previously doing. No matter how your economy is structured, that’s gonna be a constraint.

And sure, the way that gets expressed is via profit – that is, if the company down the road is using one guy in a Bobcat and our company is using five guys with shovels, in a competitive market, that company is gonna undercut our prices and take our business. Competition means our profit drops off, we start losing money, need to take the Bobcat route ourselves or go out of business. But I don’t see as how it changes all that much. If there were a command economy, you’d still have to either have someone say “okay, no more shoveling, now it’s Bobcats”, and the same disruption happens or you have to freeze the economy.

-

Sounds like something the government should regulate…

You sound like an economist.

They may be but they aren’t a very honest one if they are. The idea that the only options are letting corporations take all the gains or a riot at the job site is very anarcho-capitalism.

jeezus Christ Lemmy. what’s up with the downvotes?there is one response at this time and 16 downvotes. the response isnt even disagreeing with the sound theory presented, just saying that our system is too fucked up to work right.

I thought this community was better than this.

Because it’s a wall of text trying to justify why we’re all struggling, and I think people are just done trying to engage with such “galaxy brained” theories that are completely removed from our lived realities. Especially when people probably have better things to do than some point-counterpoint internet argument.

Not to mention, this “sound theory” is just that: a theory. Frankly, all of economics is entirely made up! That’s not to say it’s not a valuable and important study, but it’s also not based on any natural laws. It’s an entirely human construct and something we don’t fully understand. ANY economic theory can be torn apart in thousands of ways by adjusting the models a bit. In the west we’ve been fed the theories from Margaret Thatcher and Ronald Reagan for longer than most of us have been alive, and it seems like those theories are falling apart around us! I think a lot of people are seeing that when GDP goes up and “the markets” go up, we don’t get anything. But when “the markets” go down, we have to immediately shoulder the burden. We see our hard work being absorbed by investors seeking their ROI. We see our loyalty repaid by mass layoffs so executives and investors can earn even higher profits.

So when someone tries to justify it all using the same theories and models that seem to be causing the problem, I don’t blame people for just down voting and moving on.

We’re tired of being trickled down on and it’s time for a new theory.

the downvote button shouldn’t be a disagree button, but a your not adding anything to the conversation button.

Anyone who argues against knowledge and science should immediately be disbarred from the democratic process.

Because, as it turns out, Leftist fee-fees are more important than facts.

I swear, they’re just MAGAs painted blue. Same lack of critical thinking. Same rage. Same propensity for being manipulated.

Alternate headline: “Why Humans Dislike Being Poor”

Americans are right now at some of the best economic times, so that’s surprising

I’m so tired of repeatedly posting this but you fucknuggets just refuse to learn.

America has a ridiculous growth in the number of millionaires these last 10 years.

And nearly ALL of them are children from wealthy families.

They skew the median income bracket making it look like most Americans are making 65k+ a year.

This isn’t the case, and 60% of Americans live paycheck to paycheck.

And people like you are actively trying to hide this.

Look, if the median is 70K it means 50% of households are making this much

That’s what median means

Median as you’re using it doesn’t tell us much beyond a very general bit of information.

For example both of these data sets have 5 as a median. But in the second one you would not say 5 is representative of half the country.

[1,2,3,4,5,6,7,8,9]

[1,1,1,1,5,5,6,8,9]

Yes, but the average is HIGHER than the median so it’s more like [1, 2, 3, 4, 5, 10, 12, 15, 22]

Well yeah, those weren’t meant to be representative. That would look something like,

[1,1,2,2,5,6,7,15,22]

It’s more like [2x10, 3x20, 4x20, 5x10, 6x10, 7x5, 8x5, 9x5, 10x5, 12x5, 13, 15, 20, 40, 200]

The whole point of using median is that 0 is fixed, but the upper bound is not, so median is way better than average.

So sure in your example it is not a good measurement, but your example does not represent the real world distribution.

The real word distribution of wealth is actually kind of insane.

And that’s forcing people into Quintiles. When you look at the income distribution before the median it becomes very clear it’s not a straight slope or at least not in the good way. This was ten years ago. As you can see the median does not represent the mode. Which is what people think of when you say median.

I’ve never heard of anyone mixing up mode and median, it’s always mean and median.

70k is not enough in many states anymore.

I’m a Europoor, and 70k USD wouldn’t be “comfortable” even here. Maybe in Eastern Europe, but rents and house prices are soaring there as well, so I’m not sure.

That’s right, but the average in those more expensive states is also higher. But I do agree the states that don’t build new housing (the states where rents grow faster) are not affordable

I think you are mistaking median and mean.

The median household income is 70K+, not the mean

There is a disconnect between the statistics and reality. I am not sure where, but I suspect inflation is not being calculated correctly. It may be that lower cost items rose at a higher rate, so even though it averages out, it’s harder to reduce spending. 17% doesn’t seem to match the numbers I’ve seen for take out and home prices for example.

At the end of the day, it doesn’t matter what’s on a chart it matters how many things people had to choose to not buy or do because they couldn’t afford it.

Didn’t they just adjust the whole inflation index again to not count a bunch of significant things? It’s a joke.

Same with unemployment. It only counts “able individuals who are actively searching for a job”. A lot of people aren’t included in those numbers when they should be.

The inflation index is and has always been a metric for the rich.

The reason that most of the excluded things are not goods or services the wealthy use is so that those companies can profit more from the already economically burdened all while shaming those same burdened people by saying 'You can’t be struggling, inflation has ONLY been 6%!

Sure for yachts and luxury cars the prices have barely changed but generic meat and fresh vegetables have literally doubled in price in 4 years while the high end offerings have gone up less than 20%.

Sure for yachts and luxury cars the prices have barely changed

I’m not sure if that’s actually true, but I’d note that for certain luxury goods, weird things happen with prices. You can wind up in a situation where higher prices make a good more-desirable because it’s more-exclusive, more of a status symbol.

https://en.wikipedia.org/wiki/Veblen_good

A Veblen good is a type of luxury good, named after American economist Thorstein Veblen, for which the demand increases as the price increases, in apparent contradiction of the law of demand, resulting in an upward-sloping demand curve. The higher prices of Veblen goods may make them desirable as a status symbol in the practices of conspicuous consumption and conspicuous leisure. A product may be a Veblen good because it is a positional good, something few others can own.

For luxuries like that, the price can be largely decoupled from the cost of production, and can instead be linked to ability to pay. Like, if the reason you’re buying something is to show off that you can afford to pay the price, the cost of manufacture may not be what sets the price, even in a competitive market.

That being said, that’s not all that common. It probably doesn’t apply to whole classes of goods, but rather specific things like a brand (since if there’s interest in the thing other than as a status symbol, competitors can produce a cheaper thing and find buyers). And the reason that it can be decoupled from the cost of production is only because the price is well above the cost of production.

CPI does not include yachts in its calculation

Food goes up 20%, Consumer electronics go down 20% and they’ll call it zero inflation. Not an exact example but an illustration of why things dont feel right. The things you have to buy most often are rising faster than the luxuries. Education, Healthcare, Housing it’s a similar story there.

Correction: Food goes up 20%, housing prices go up 80%, Consumer electronics go down 20% and they’ll call it negative inflation. The things most important to people and their biological survival are intentionally not part of the CPI so, they get ignored in most inflation reports.

EDIT: To be clear, the CPI tracks “in-place” or active rent paid by tenants plus utilities (and subsidies, where applicable). It does not track current asking prices or purchase price as it considers purchasing a home to be an investment. This means that it is a very poor way of measuring the housing situation.

Rent/housing is like a third of CPI, it’s already being taken into account. Remember, CPI already talked into account these numbers, including higher food costs. But it also takes into account that energy costs did not increase as quickly. Even if some things went up 30%, if other things go up 10% the average can’t possibly be 30%

Also consumer spending is very strong in America right now, so even if some people can’t afford things, other people are way outspending them

The CPI only takes rental prices into account, not home purchases or rental values. Additionally, it only captures active rentals, not asking prices, meaning that it has significant lag and is a poor indicator for trends in rental prices.

This is true, but the average person is paying a mortgage or rent, not moving every single month so the current rental price is the most relevant to people’s expenses

There is a disconnect between the statistics and reality.

No, there is a disconnect between statistics and perception.

The statistics are reality.

That is a shocking take in my opinion, one that borders on delusional. Statistics are the result of specific metrics collected by people who chose what specific data points to collect, the methods of collecting those metrics and chose the methods of presenting the data. They can reveal interesting aspects of reality that aren’t otherwise obvious and can depict a fairly accurate representation of reality as a whole if they are created in ernest using sound data collection techniques, but I’m pretty sure that the most qualified data scientists will disagree with the statement that “statistics are reality”. Especially if anyone in control of any part of that process has significant motivation for them to depict something specific.

Statistics are only meaningful when you put them into context of their intent, limitations and error rate.

Lies, damn lies, and statistics

And even if the statistics hold true in aggregate, it’s not the full picture and can’t accurately describe or predict individual experiences. Perception is anecdotal, so it is not a perfect depiction of reality either. But if perception does not match the data, it’s an indicator that the data might be suspect.

but I’m pretty sure that the most qualified data scientists will disagree with the statement that “statistics are reality”.

Only because scientists are absurdly cautious in nature.

Statistics are reality when compared with a different interpretation that is wildly diverging from all statistics. Fuck the equivocation and the “maybe” and the “suggest that possibly”. On something this stark, we can use very clear language:

The statistics represent reality. The complaining about the economy represents perception.

I feel like you’re putting me in a position to argue against the scientific method, but I don’t think that’s actually the case. Statistics can be scientific, they can also be wrong. The scientific process allows for skepticism. To not consider questioning the methods given opposing perspective is not scientific, it’s dogmatic.

The statistics may very well be accurate, but your level of faith in them is disturbing.

You’re suggesting that since statistics are fallible, it’s entirely possible that the sun doesn’t shine during the day, despite the wealth of evidence that the sun does in fact shine during the day.

No. Fuck that. The cautiousness of the “global warming is just a theory” scientists enabled the regressive anti-science bastards. I’m not placing the whole of the blame on the scientists. I’m just saying that equivocating when there is a preponderance of evidence can have real world harm by giving credence to fabrications.

If we were in a situation where we all agreed on a basic level about the general accuracy of the statistics, then we could drill down into what, specifically, is more accurate than others. I definitely have my qualms about how the CPI is calculated for example, and how the unemployment rate is calculated.

But when we’re in a situation where bad faith actors are trying to discredit the broad findings that all the stats and scientists agree on, we need to close ranks and tell them in no uncertain terms that they are wrong.

Corporate price gouging

Ding ding ding. I have no idea where they’re pulling these numbers from when my grocery bill has doubled since the pandemic. I wish it was only 26% higher.

Yeah I agree, anecdotally my wife and I spend roughly $200 a trip when we used to spend about $100. It may not be exactly double but it’s very close.

That’s pretty much exactly my experience. I’m a perpetually single dude so it’s just me, but my weekly bill went from ~$60 to ~$100 and it hasn’t budged since.

Supply and demand is such a fucking disgusting “theory” that is only used as an excuse to raise prices, never to lower them…

Amen to that brotha.

Middle class is the new poor. Shit broke in the 70s and it ain’t likely to get fixed. Get used to it.

deleted by creator

Yeah, y’know, just kinda bummed out.

Bit mitted about it.

I’m not a R but the Democrats seriously need to stop pushing this shitty “economy is awesome” narrative. Because everytime someone hears it who isn’t feeling the economy, it makes them hate the Democrats a little more. Staying home and not voting because your candidate has pissed you off, is just as bad.

For anyone who hasn’t recieved a 20% pay increase, the economy is not good. In fact you’d need about a 35% to 50% pay increase to be feeling the same as you did pre pandemic. If you job hopped during the super awesome fun times of Covid hiring and got a boost in salary, then yeah you’re new salary offset by new higher prices makes the economy feel better than it was.

But if you’re the majority of people who did not get 50% adjustments, you are having a bad time. You are factually worse off financially than you were.

The idea of blaming who or what made the bad economy is a lost game. Bush tanked the economy, Obama got the blame. Trump tanked the economy, Biden got the blame. But just because Biden didn’t tank it, doesn’t mean it isn’t tanked.

There is nobody, not a single person, I know of that is doing better today than 2020.

It’s the gaslighting that’s pissing people off. “The economy is great!” … “For who?!”

In fact you’d need about a 35% to 50% pay increase to be feeling the same as you did pre pandemic.

https://data.bls.gov/cgi-bin/cpicalc.pl?cost1=100&year1=202001&year2=202402

That’s high – CPI is up 20.29% from January 2020 to February 2024.

Yes but the data is skewed. The 20.6% is true. But if you don’t buy those items that’s not the amount. Many items are double what they were. Lots over 50% increase.

Vehicles, insurance rates, computer components, huge increases. Eggs, milk, and bread 20%. Not everyone is buying only staples.

I’m doing better. Though I did switch jobs in 2020 and 2022, which offset most the inflation.

Yes you’d be one that job hopped during the best time to. Before layoffs with huge increases. For you with 2 hops even with high inflation, you’re probably better off. Which is awesome. But abnormal.

I did increase my salary by close to 50%! I still hate it. I still can’t get out of debt without spending the next 5 years repaying it and you bet your ass I’m not seeing a possibility to ever buy a house unless I land a unicorn local first time buyer scheme which I imagine has a massive demand for.

Shit is fucked. I’m in the top 1 or 2% but so much of my money goes to rent in a tiny ass village with a 30 min commute that the situation is just depressing.

So you’re making 200k+ a year and can’t afford to pay your debts? Sounds like a money management issue with that kind of salary. To put it in context a modest rent of $2000 a month would be about 24000 a year out of your 138000 take home pay. So either you’re not in the top 2 percent or something’s fishy.

People accrue debt during bad times then have to pay it during good times, but often couldn’t have made it through to those good times without spending on the way. I am still paying off the accrued deficit from when we had a family of 4 living on 15k a year, then later 6 on 50k, we were always so close to ok but not quite and year after year it accrues. Well during that time I went to university, made more but still not enough for a family, eventually split with my ex, now in a functional 2 earner plus couple of part time jobs situation we are sorta raking it in now but both still paying for when we were not.

People who make good money probably didn’t always make good money. People who raised other people also take a financial hit for awhile. I’m assuredly better off from having kids, wouldn’t have bothered getting the degree and better job without them, but the payoff is slow not immediate.

That’s why there are bankruptcy protection laws. If you have a debt you cannot pay off you should strongly consider bankruptcy. Your credit can recover in a couple of years.

It’s the same reason Republicans are asking “are you better off than you were four years ago?”

Anyone with an existing ideology probably knows who they are voting for. Swing voters are emotional.

Republicans are whistling to those just willing to judge the economy based on a Democrat being in office.

Biden is trying to thread the needle by pointing out there have been positive indicators without shirting on his own policies or advocating straight up anti capitalist messages.

After the primaries, the race is always a race to the middle.

The issue is the Republicans are correct. Are you better off now vs 4 years ago financially? For the majority of Americans, that’s a no. For almost all Americans that’s a no.

Even on MSNBC they never answer that question financially. It’s always about being locked up during Covid, stacking the courts, etc. The only thing doing better are stocks which are worthless until you cash them out. And the minority of people who job hopped.

Democrat voters aren’t idiots like republicans. Telling them you’re doing better when they factually are not will grind many peoples’ gears.

Yes the Biden years have not been some sort of economic triumph, but if you take the question at face value, how were things four years ago? They were horrible. Unemployment was record highs. Stocks had tanked. Hundreds of thousands of people were about to die. Etc etc etc.

That’s the problem with the binary decision, about the role of president, who doesn’t even make a lot of the critical economic decisions anyways.

The economy is not “good” but many indicators have been improving or are better than expected. But mishandling an event like a pandemic will certainly tank the economy, just like neoliberal policies will generally lead to a good stock market and little else.

But the Democrats are specifically touting you are better off financially. The whole pandemic thing and death and unemployment is a different topic. If you add up all the Americans that switched to a higher paying job in the past 4 years that offsets inflation I don’t know what the number would be.

If it’s 6 million jobs a year (6.4m in 2021) and 50% get a raise, that’s 3million peeps a year better off. 4 years, 12million people. 12/300 is 4%. So the economy is factually better for 4% of the country.

That’s not a “the economy is doing great!” slogan. That’s a “4% of the working class is doing great! The other 96% can suck rocks and like it”

Edited: The 50% came from a self reported study in 2022 that said 50% of respondents said they were paid the same or more in their new job. Even if it was 5% more they’re included in the above number. So I feel this is a very generous number of 4%.

Because capitalism inherently brings corruption, and when a bubble bursts the fever goes down and we think things are OK… until the next bubble

The bubble will burst eventually, it’s just a matter of when. Unfortunately it’s not next week.

Yep, then enter goverment “action”, the regular news cycle and then once everyone calms down shit will just go back to business as usual until the next bubble

Looking at history, Id rather say humans bring corruption regardless of the system we’re using.

There was no time or system ever where corruption wasn’t a thing.

This is true and Socialism isn’t a silver bullet, it always falls on the people to make whatever political model work.

That’s why you gotta buy high and sell low, like I do!

My rent is 93% higher than it was in 2019

80% higher for me. It went up 29% from November alone

They really be cherry picking the numbers to tell us everything is fine and we’re the ones who are wrong.

They’re taking averages, that is literally the opposite of cherry picking. If your experience doesn’t match the national average that doesn’t mean the average is wrong

Yea, most of these estimates I’ve seen are wildly understanding the increased costs of everything.

Tbf these are national averages and rent increases are highly localized.

My rent gone up 11% since 2019. Which is good, because I already can’t afford medical care.

My sister’s rent has gone up almost exactly 50% in the same time period.

the average basket of goods and services that most Americans buy in any given month is 17% more expensive than four years ago.

That’s 4% per year

And now much has pay gone up?

They claim it’s gone up more than that, but I’m very curious where they’re getting these numbers.

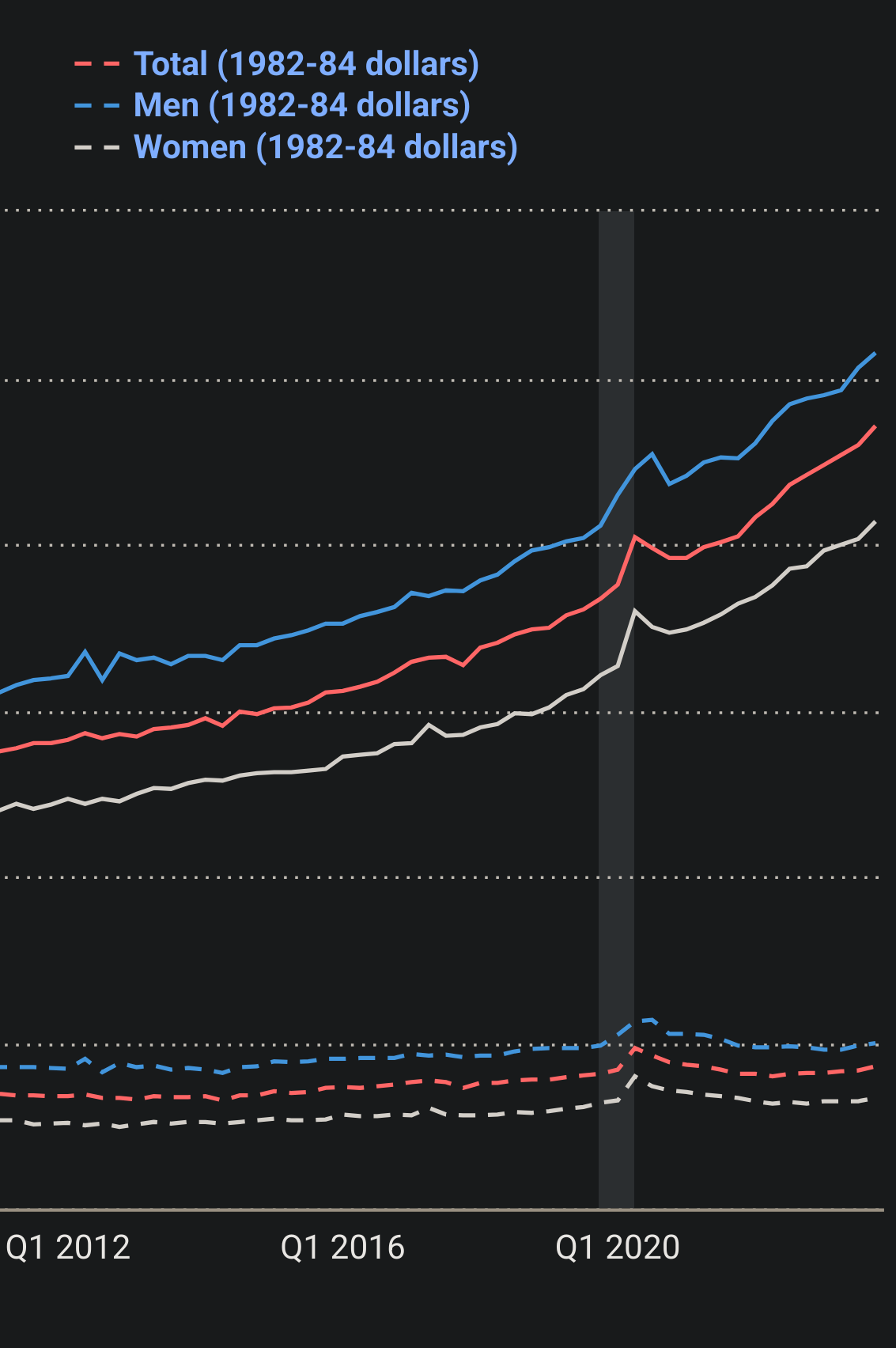

Here’s US bureau of labor statistics:

Pay went up faster than inflation compared to before the pandemic

That graph shows real wages as being flat for the last 24 years, and even the bump you mentioned was barely noticable and fell back to baseline in like a year.

What would the chart look like when we exclude billionaires, C-suite executives, and everyone else who gets paid to own stuff instead of working for a living?

Well is it average or median?

Median is an average.

I can’t tell if you’re joking.

It looks flat, but real wages are up 10% in the last 24 years, highest ever

If we exclude billionaires it will decrease like $0.01 because it’s the median

It’s gone up more than 4% per year for the past 3 years. Even the article mentions a 5% increase when accounting for inflation. Though that seems high; the article is a mess.

BLS:

-

Compensation costs up 4.0 percent from December 2020 to December 2021

-

Compensation costs up 5.1 percent from December 2021 to December 2022

-

Compensation costs for civilian workers increased 4.2 percent for the 12-month period ending in December 2023

Obviously this is flawed as we don’t have data for December 2024. 2019-2020 wasn’t a great time overall, but really we need the data for March to March, etc.

-

This was at my grocery store the other day in the LA area.

It’s literally just wheat meal with honey, it costs literally 12 cents a box to make.

The packaging is more expensive.

But capitalism says ‘lol it’s ok to charge whatever!’.

And 1/3 of the internet will defend them for ‘reasons’.

Where did you get “it costs literally 12 cents a box”? Is that a random number for effect or do you have some insider knowledge and know that for sure?

Either way is fine with me, just curious because it seems like a very small amount after paying for the raw materials, the workers wages, the shipping costs, and the grocery store overhead, etc.

And 1/3 of the internet will defend them for 'reasons

I’m one of the people that often jumps in on posts like these. It’s hardly defending them, hear me out.

I’m not in the us, I looked at that picture for 45 seconds straight to understand what’s wrong with it, I assume it’s the price but I have no idea what that shit is so I had to read all the words on the package to understand if it was another issue…

The good news is that your life doesn’t depend on eating this shit. Don’t like the price, don’t buy it.

I hate how a serious issue, prices are going up is diluted down by people bringing in stupid arguments like Starbucks “coffee” costing a fortune or Netflix jacking up prices. My point I am not defending Graham, Starbucks nor Netflix, just stop buying overprinting that you don’t need or if you really do, stop complaining.

Now if we want to talk about the price of actual groceries, like fruit vegetables and meat we can all have a serious convo

hear me out.

I don’t think I will.

That’s insane

https://www.walmart.com/search?q=honey maid graham crackers&typeahead=honey maid

When I choose a Walmart in LA, it says that they have it for $4.68. That might just be the particular store charging more, rather than stores in the area in general.

I lived in L.A. Getting to a Walmart would be a big challenge in a lot of parts.

bummed out just seems like a wildly inappropriate phrase for this topic

Well that 1% guy wasn’t joking when he said “You will own nothing and be happy.” Except for the “you will be happy” part. They’re doing this to us on purpose and they have their reasons.

Used car prices are 34% higher

My understanding is that that is specifically due to chip shortages in the auto industry during COVID-19. New car production fell off, so used cars acted as a partial substitute, which drove up used car prices.

There’s also the disconnect of what is being made by manufacturers versus what many people want. An overpriced and massive luxury SUV has never appealed to me, yet that is basically the primary vehicle being made. I could buy a new car if I wanted to, all 3 of mine are paid off but there isn’t a single new car being made that I want to drive more than my 2017 Ford Focus. If it was totaled tomorrow I would absolutely pay a premium to get it replaced rather than buy something new. When supply is low prices come up and used cars are a commodity that is desirable to many and not available from current manufacturers. 5000 lb EVs just do not appeal to me in any way.

Car companies have done the math, and the higher profit margins are worth the reduced sales. They’re going for the rich market.

And dealers have done the same math. Inventory is based on the highest spec they think they can force onto someone coming in for a mid tier vehicle. You want an F-150 with a regular or super cab? Too bad, that $40k truck simply doesn’t exist. Your options are a $65k SuperCrew® on the PLATINUM, which is marked up another $15k because there’s only one and 4 other people want it more than the $83k Limited, (also with a SUPERCREW cab). Meanwhile 2004 Rangers with 200k miles are solid gold on marketplace because you literally can’t buy them anymore.

Everyone will say “they make what sells” but that’s bullshit. They spend millions to market and convince people they need the largest vehicle they can get away with producing. “Oh, you’re having your first kid? If you don’t have 14” of ground clearance and a 3rd row you won’t be able to survive.” A 2009 Jetta is just fine for a small family. If you need cargo space, they make a wagon. Just make fucking cars again.

Sounds like I’ll be keeping my 2008 Toyota alive until the end of time then

Everyone will say “they make what sells” but that’s bullshit. They spend millions to market and convince people they need the largest vehicle they can get away with producing.

I guess it could be rephrased to “they make what they can sell”.

Definitely, meanwhile I guess I’m only buying used cars for the foreseeable future.

Too bad, that $40k truck simply doesn’t exist. Your options are a $65k

Light trucks in the US are subject to a 25% import tariff. That drives up their sticker price relative to other vehicles.

https://en.wikipedia.org/wiki/Chicken_tax

The Chicken Tax is a 25 percent tariff on light trucks (and originally on potato starch, dextrin, and brandy) imposed in 1964 by the United States under President Lyndon B. Johnson in response to tariffs placed by France and West Germany on importation of U.S. chicken.[1] The period from 1961 to 1964[2] of tensions and negotiations surrounding the issue was known as the “Chicken War”, taking place at the height of Cold War politics.[3]

But I don’t get this:

Meanwhile 2004 Rangers with 200k miles are solid gold on marketplace because you literally can’t buy them anymore.

It’s not something that I’ve followed, but according to WP, it looks like Ford restarted production of the Ranger in 2019.

https://en.wikipedia.org/wiki/Ford_Ranger_(Americas)

That’s apparently as a larger vehicle than it had been, albeit smaller than the F-150, but they also apparently started making a small pickup, the Maverick, as of 2022:

https://en.wikipedia.org/wiki/Ford_Maverick_(2022)

If that meets what you’re looking for and you haven’t looked at the market in the last five years since those two vehicles came onto the market, Ford might be doing what you’re wanting them to do.

Fwiw, the new ranger is basically the same size as the old f150. The maverick would be closer in size to the 04 ranger, but they don’t make anything other than crew cab for those.

Small imported trucks are subject to the chicken tax, they could still be produced domestically without the penalty. Unfortunately manufacturers refuse to make them. The new Maverick is virtually the exact same size as the F-150 was when they discontinued the Ranger the last time around and the new Ranger is even bigger. Everything has grown immensely in size and price.

The chip shortage is the auto industry own fault. Historically auto manufactures used older prosses nodes (40nm) as it was cheap and widely available however that node they are on is now outdated to the point where there’s not that many fabs manufacturing that size of chips anymore.

To make things worse the silicon industry moved to a larger wafer design which would require the auto industry to invest in new hardware to support the larger wafer and redesign/validate the ICs for the smaller node all of which requires spending money they won’t see a return in for a significant amount of time.

Manufacturers also cut production in march of 2020, stating that it was for worker safety. However, I believe it was because they figured sales would plummet if the pandemic was very bad. I assume their projections for death were much higher than in actuality. With COVID mainly affecting older people they did lose a large amount of new vehicle buyers as older people are much more likely to buy a new vehicle. When they shut down production, it had hysteretic effects down the supply chain due to jit (just in time) manufacturing. Without orders, may suppliers also had to cut production of vehicle parts, especially chip manufacturers, which are mainly in China. When vehicle production started back up, suppliers had to also catch up with demand.

And I’m sure the sources of this explanation are the very car companies who jacked up their prices.

Is it because of the economy? That’s my first guess.

No, because we have some of the best economy ever

We’ve had higher median real incomes than Q4 2019 since Q3 2022

The whole 2020 decade so far has higher incomes than any point in US history

It’s because we’ve let foreign agents control the social media narrative.

Grocery prices are ridiculous. They need to start coming down soon. But I wonder how much of this is linked the Suez Canal and Houthi conflict? Could be a big reason