To be faiiiir, the USA absolutely has messed up China, it’s just that China has the capability, the capacity, and the conditions to heal.

How are eu nations (other than farmers) not losing their shit over deindustrialization and the trajectory of their servitude? If I were the biggest chud finance bro, I’d still be studying China and looking to maximize my network there based on their momentum independent of Amerika.

In Poland, since 90’s we are being actively misinformed in media and education system about economy. Industry is presented as obsolete by its nature, finance, service and rent is portrayed as the markings of modern, healthy economy. It’s probably exactly the same in other EU countries.

The farmers??? The goddamn

“Pwease let us dump the mega-death cancer chemicals into the water supply 🥺🥺🥺”

Those farmers??? The actual fascists oftentimes?

It’s more that the the revolution came to a crescendo in 1949, fighting still continued after 1949 when they formed the PRC, but armed revolt started in 1927 with the Nanchang Uprising.

fr, the dude is a patsoc

generally yeah I agree

Removed by mod

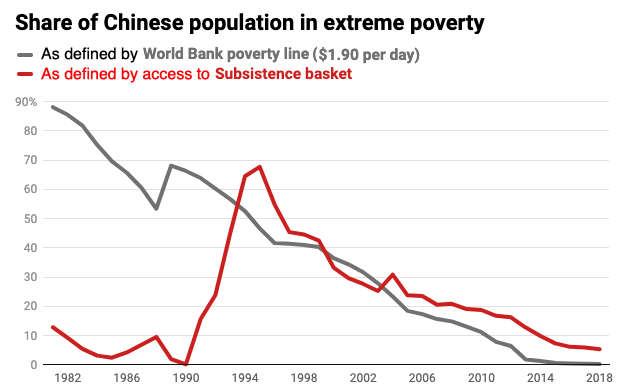

The actual data seems to disagree with your assessment

The real (inflation-adjusted) incomes of the poorest half of the Chinese population increased by more than four hundred percent from 1978 to 2015, while real incomes of the poorest half of the US population actually declined during the same time period. https://www.nber.org/system/files/working_papers/w23119/w23119.pdf

From 1978 to 2000, the number of people in China living on under $1/day fell by 300 million, reversing a global trend of rising poverty that had lasted half a century (i.e. if China were excluded, the world’s total poverty population would have risen) https://www.semanticscholar.org/paper/China’s-Economic-Growth-and-Poverty-Reduction-Angang-Linlin/c883fc7496aa1b920b05dc2546b880f54b9c77a4

From 2010 to 2019 (the most recent period for which uninterrupted data is available), the income of the poorest 20% in China increased even as a share of total income. https://data.worldbank.org/indicator/SI.DST.FRST.20?end=2019&locations=CN&start=2008

By the end of 2020, extreme poverty, defined as living on under a threshold of around $2 per day, had been eliminated in China. According to the World Bank, the Chinese government had spent $700 billion on poverty alleviation since 2014. https://www.nytimes.com/2020/12/31/world/asia/china-poverty-xi-jinping.html

You have overly simplified China’s economic growth without looking at it as distinct phases of an economic development history.

Deng’s reform was only possible because of the first 30 years of industrialization under Mao (helped massively by the Soviets in the early years). China already had world-class heavy industries (e.g. shipbuilding and infrastructure building) when it opened up to the world. This was what attracted Western capitalists to China, instead of other developing countries.

Dengist reform worked really well for the first 20 years, until it didn’t. The PRC experienced its first economic crisis in history in 1995, which led to record unemployment and poverty:

The transition period was challenging. This was the first critical hinge point where China could have transitioned into a domestic consumption (internal circulation) economy, but instead they decided to join the WTO in 2001 to save the economy. This was accompanied by a huge loss of labor rights and deteriorating working conditions just to compete with the rest of the world to produce cheap goods made by hard working Chinese labor to satisfy the insatiable demands of Western consumerism.

It worked well for a few years, then the 2007 subprime mortgage crisis quickly turned into the 2008 Wall Street financial crisis, then into the 2009 global economic crisis. Western consumer demand slumped, and Chinese manufacturers were at severe risk of shutting down production.

This was the second hinge point where China could, once again, have transitioned into an internal circulation economy. Instead, China decided to invest massively into infrastructure building and rampant real estate construction. Property market, that never existed under socialist China, emerged for the first time in 2009. This may sound like a good idea at first, but it is accompanied by far reaching consequences that China is still struggling with today.

How bad could it be? Let’s dissect this in detail:

In an attempt to save itself from the Wall Street financial crisis, the US turned to large scale currency issuing, and through quantitative easing (QE) created $3.9 trillion US dollars. More than 60% of this dollar liquidity ended up in the international commodities market and caused serious inflation. China as a manufacturing country imports nearly 70% of their raw materials and energy (as well as food), and the inflated commodity price had resulted in a severe hike of PPI (producer price index) which plunged the profitability for the manufacturers.

This plummet in the real sector (as a country enters a recession) triggered vast capital outflows. Where did they all end up? The real estate sector.

This over-investment in the real estate has created a serious problem for the central government down the road. >50% household debt and >50% of corporate debt are now mortgage debt. This means that much of the national income was not spent in the real sector (for consumption), but instead went into servicing mortgage debt and inflating the real estate sector.

Additionally, 60% of household assets are now in the real estate. What this means is that if the real estate sector crashes, there is going to be a serious plunge in household assets as well - a lot of people are going to lose their wealth. Similarly, much of corporate assets are also in the real estate, which means that corporate asset value and the stock market will plunge if the real estate bubble is allowed to burst. A lot of companies are going insolvent if that happens.

But this is not all. We’ve talked about property developers and financial investors above. But there is an even deeper problem to this crisis: as the investment outflow from the real economy all went into real estate, local governments in China found themselves no longer able to generate adequate revenues from the real economy. Their solution? Convert land from a long-term cultivation/development resource into short-term revenues to make up for the losses from the real economy through land sales (more precisely, through land enclosure and making profit from the price difference of the land development).

Through this, local governments became entangled with real estate developers. But this is still far from over. As the local government expenses grew from a slumping economy, its debt inflated as well. Local governments were then forced to take out loans from commercial banks to service the interest payments of the old debt, just so they can be granted the issuance of new debt to finance their operations. In other words, borrowing and selling land to pay off old debt just to get new loans to continue financing the local governments - an endless spiral of debt crisis in the making.

How bad is all this?

China now has already built enough housing to accommodate for 6 BILLION residents, in a country of only 1.4 billion people. Most of the properties will NEVER be sold. There will never be enough prospective buyers for those newly constructed houses. But why did they keep doing it?

This, once again, stems from the debt bubble of the local governments. The total local government debt amounts to 37 trillion yuan (2023), but this is not counting the hidden debt from city investment firms etc., which adds another 66 trillion yuan - a total of 103 trillion yuan indebted. A huge proportion of these loans were taken for the purpose of servicing mortgage debt.

According to research, 90% of the local government debt came from prefecture-level and county-level cities (mostly cities below Tier 3 and Tier 4).

But why? Why is everyone building new housing properties when everyone already knew those properties will never find their buyers? This is because real estate development generates a huge amount of GDP for the local governments. The current system of evaluation judges the performance of local government weighed heavily on GDP numbers, and local officials who want to be promoted simply could not do it by investing in the real economy when cheating through real estate is the way to go. Every city government raced to boost their GDP by investing in real estate to compete with one another, resulting in an over-investment in the real estate.

This was the strategic decision made by China after the 2009 economic crisis. The second hinge point that could have led them into an internal circulation model instead of the mess they have right now - too much money is being tied into the real estate sector that everyone will lose something, if not a lot, if the bubble bursts.

As you can see, there is no easy way out of this. The crisis is complex that entangles various key players in the economy. Everyone from your average households, to the corporations that had nothing to do with real estate, to the financial institutions and shadow banks, to the local governments - they are all at risk because so much investment and debt have been tied to real estate.

No, China is not going to collapse like some people are fantasizing, but let’s not pretend like it’s not a challenging crisis to resolve.

As I have always emphasized, an internal circulation/consumption economic model is the only way forward for China.

So yes, to answer your question, the US has messed China up. Just not enough to collapse it.

The primary goal of opening up was to achieve technological parity with the west. And this worked spectacularly. China received a massive amount of tech transfer from western companies, and has now become an industrial superpower. Opening up also resulted in millions of workers being trained, students getting education at top western universities, and so on. This was absolutely the right decision from the perspective of developing the productive forces of the country.

It’s also important to note that 90% of families in the country own their home giving China one of the highest home ownership rates in the world. What’s more is that 80% of these homes are owned outright, without mortgages or any other leans.

Given that vast majority of people own their housing, it’s pretty clear that real estate in China isn’t used for landlording and an investment vehicle the way it is in the west. The government is now intentionally winding this sector down. There aren’t any bailouts happening, so this in no any way comparable to 2008 crisis in US. Assets of these companies will be nationalized and a handful of rich investors will lose money.

Furthermore, the government can simply write off its own debt because it controls the currency. Michael Hudson explains how this is going to work out here. There wouldn’t be an easy way out of this in a capitalist country because capitalists wouldn’t accept taking a loss, however there’s a very clear out of this in China.

And of course, China is actively working on developing internal circulation economy, that’s the whole point of the dual circulation policy they’ve been pursuing.

Meanwhile, overall Chinese economy is starting to transition towards high tech sectors, particularly in renewable energy, space, and computer production. China is also increasingly using the skills they developed building infrastructure domestically to export infrastructure production to other countries.

So, I completely disagree with the assertion that US managed to mess China up. Every economy has ups and downs, every government makes mistakes. China is no different in this regard. However, none of the mistakes the party has made to date have had any major negative impact on the overall trajectory.

I found a YouTube link in your comment. Here are links to the same video on alternative frontends that protect your privacy:

Fantastic post. Thanks for the education, comrade

Hey, do you mind providing any sources?

90% of the information on property bubble came from this Wen Tiejun’s video, translated by myself from Chinese.

If you don’t know Wen Tiejun, he’s a Marxist economist and an expert on the “three rural/agricultural issues” (三农问题), and a close collaborator with Michael Hudson (a lot of Hudson’s lectures is also on the youtube channel).

Information about trade came from various blog posts from Zuo Da Pei (左大培) and Jia Genliang (贾根良), both of whom are well respected Marxist economists in China. You can search for them if you know Chinese and their articles will come up. Information about internal circulation model came from Jia Genliang’s《国内大循环:经济发展新战略与政策选择》 (The Great Domestic Circulation: new strategies for economic development and policy choices).

I am actually surprised the comment got deleted by the mods, since what I have been trying to show is to educate about the complexity of challenges that China has had to face, which has been way too over-simplified and trivialized by OP, and misses the fact that China has to constantly adapt to a changing global environment imposed by a hostile global hegemon, and along the way made many mistakes that are deemed conservative by many Marxists in China.

you should repost this on hexbear

I actually did post it once in my previous account, which I have since deleted. Most of the property bubble information came from this Wen Tiejun’s video which I translated myself from Chinese. It’s actually only the first one of a three-part series and I never found the time to translate all of them, since they are very educational and informative.

I’m too lazy to type up everything again but do check out the News Mega on Hexbear, if I ever found the time to the post some materials about Chinese economy, it’s going to be there.

Thank you for extra information. If you’re the person I think you are, then I felt like the scrubbing of all your old comments/posts was a big loss to the collective information and wisdom that can be found by digging through hexbear. I rolled my eyes at the foolish decision to remove your informative comment here in this thread. I mean, agree or not, it’s great having an actual Chinese perspective, and then to see it get deleted on a pro-China thread as “ultraleftism” was very funny. But it was a gutpunch when I saw you had deleted all the comments on your old account! Keep posting, comrade, some of us really do appreciate it.

Removed by mod

Found wisconscom’s alt

nah garbageshoot is a real one, has been on hexbear for long enough without being hoxha-y

I really hope you can offer a better response than this