This is the most privileged thing I think I’ve read all week.

You don’t want a flood map made available because it affects your profits? That’s the most wildly selfish thing I’ve ever heard. It’s a real screw-you to the next generation/owners.

Why not make an open web inference where everyone can choose which areas they want flooded and which they don’t.

/s

Meanwhile, the Conservatives of Bitcoin Trump-Lite PP have no credible climate policy. Climate change costs money. And all the next prime minister has to say is …axe the tax.

Poor realtors… it turns out that reality and mother earth don’t give a shit about the housing market.

It always surprises me that when making the biggest purchase of their life people put so much trust and blind faith into realtors who aren’t required to have any formal education nor required to have any credentials to do the job.

Maybe they should be required to get a degree that covers topics like geography, land use planning, architecture, and trades related to home construction.

They do require credentials in most places, I know they do in Ontario, not sure about Quebec. Is more about the rules, and after that it’s all marketing.

What astounds me is how little thought most Canadians put into researching a home and pricing their offers. Mostly it’s just guessing close to a nearby house.

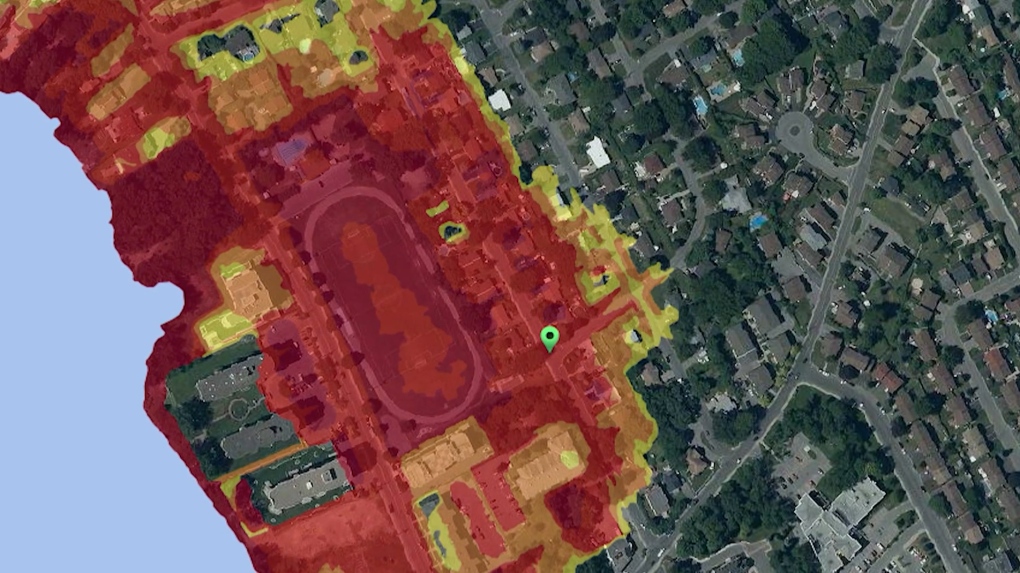

We had considered flood maps, and I used statistical models plus machine learning to tune my bid prices. I actually had a lot of fun with the whole thing.

My one house purchased late 90s in Ontario came with notes and required signoff aknowledgement that it was in a designated flood plain. So flood plain awareness should not be new to people. (The home was on a raised pedistal foundation, so flood damage should have been minimal if it occured, and price was right)

Moving out west with huge topology changes meant I always checked flood plain maps before looking at realestate. Some friends of mine called me paranoid and had a good laugh about my efforts…but I think with all the atmospheric rivers and worldvwide flooding recently, they may now understand my madness.

Yes, but typical Canadians aren’t going to use ML to price their bids. At best, for most, it’s a qualitative assessment based on realtor input, and their own judgement.

Well no, but not basing your pricing decisions on anything actually objective is frankly foolish.

A person who has a vested interest in you bidding high because it means they get paid more and get to take on more clients isn’t the person you should be basing pricing decisions on.

I doubt machine learning has been very accessible to most home buyers, especially a few years ago. Plus real estate business makes it sound like they do all that kind of work for you, and realistically that should be part of their job. I should be able to ask a realtor for a full site assessment including any environmental sampling that had been done and maps like flood maps.

Yeah, it’s something I’m very capable of, but 99% of people wouldn’t be able to do.

Between the bank issuing mortgages, the insurance companies covering the asset and assessing risk, the municipality setting my property tax rates, and the realty brokerages managing the buyers, somebody should be modelling and providing detailed pricing analysis.

This feels like an upsell to use their services, and yet…

somebody should be modelling and providing detailed pricing analysis.

This sounds like what MPAC should be doing in Ontario. The last assessment was done in 2016. Ever since Doug Ford’s PCs got elected, the Tories have been delaying them for years, even before the pandemic was a convenient excuse, and now they’ve delayed indefinitely. They also closed all of the field offices. Even when MPAC did do assessments, they didn’t track market prices well because they only did them every 4 years. For comparison, Denmark calculates these values every 2 years.

Another organization in this space in Ontario and Manitoba to be aware of is Teranet. They’re a private, for-profit company that has exclusive contracts with the Ontario and Manitoba governments. Seems shady to me that Ontario and Manitoba have allowed one company to monopolize and hoard our land registry data. In contrast, in BC, a crown corporation manages land registries data.

Water doesn’t care about your imaginary lines. Water always wins.

Are trade organizations required to say the most obvious and dumb shit imaginable for a situation? Like, is there a watch group that sees realtors blaming unsellable homes in a flood region and makes sure that no one blames the obvious changing climate while they also bemoan having to do something about it?

“Oh no, I can’t sell this very clearly marked death trap. Why won’t you just let me sell this nightmare hamlet and let me do my job!?”

I agree but also from their perspective I’m sure they don’t expect the government to help them financially to get a new house. Idk what the Canadian government is like but I’m sure it is insufficient like most others.

It’s pretty devastating to be told your home is dangerous and you have to uproot and move your whole life or lose your insurance and that no one will buy it. I’m not really sure what I would do in this situation but hiding the map isn’t going to make the problem go away.

Man, why didn’t we think of not putting these zone at risk of flooding. That would stop all these recent flooding.

Realtors should just shut the fuck up.

Flood maps should be based on science, not politics. If you build/buy a house close to water, you are taking the risk that it can be flooded, just like houses in any dangerous area: steeps hills, tornado areas, or whatever else. Crying that the house value will drop because of real risks is just egoistic. Demanding the map be changed may even put people’s lives at risk.

as overheard during that North Carolina hurricane … “if you live on the river eventually you live in the river”

Oh no, the property value which had doubled over the past 10 years might drop a little bit. This has completely ruined my finances and now I’ll never get to retire in an even bigger house.

A flood-prone property might not lose only half its value. The investor might be completely underwater. Ha ha.